How to fill in 1s enterprise correctly. How to programmatically pass the necessary data to it when opening the form? New service for autofilling statistical forms

The configuration "1C Enterprise Accounting 3.0" is designed to automate accounting and tax accounting, as well as to prepare regulated reporting in an organization.

Despite the fact that the 1C Accounting 8 edition 3.0 program was released quite a long time ago, most enterprises still work on version 2.5, and some users continue to work on the most old version, created on the previous platform - the "seven". At the same time, for users of version 2.5, the transition to 1C Accounting 3.0 is simplified - it can be carried out with a simple update, while from version 7.7 it is carried out only by a complex data transfer.

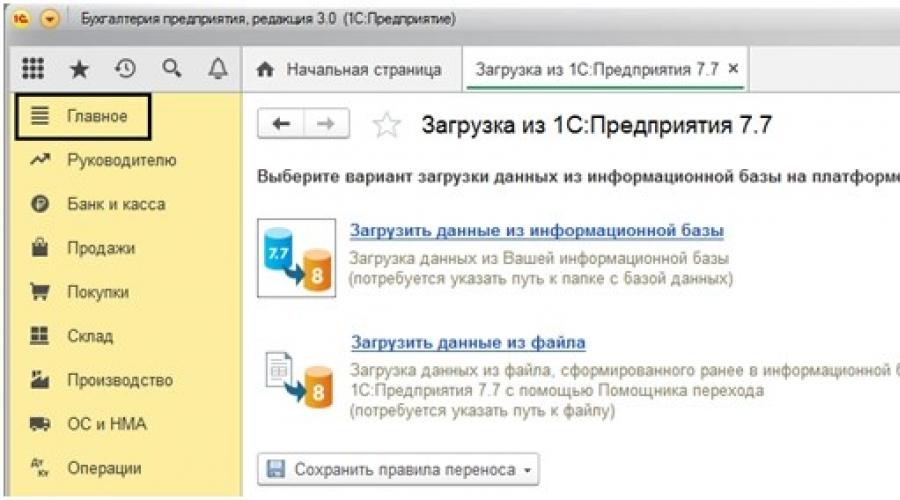

Faced with this problem of users, the developers implemented a mechanism for a simpler way to download data from the "seven", and the configuration of 1C Accounting 3.0 received such a function as "Download from 1C: Enterprise 7.7", menu "Main-Getting Started".

Fig. 1 Window of the program "1C: Accounting" (version 3.0), menu item "Main"

Fig.2 Window to load data from "1C:Enterprise 7.7"

Upgrading the old software, the user saves up to 50% of the cost of the new program.

Edition 3.0

There are currently three versions of the program in the new edition:

- Basic version;

- PROF;

- CORP.

Basic version focused on small organizations. The capabilities of the basic version differ from PROF in that it does not allow:

- Keep records for several organizations;

- Work in the program for several users at the same time;

- Change the functionality of the program and the configuration itself;

- Organize the work of geographically distributed bases.

Otherwise, the basic version has the same functionality as PROF, and if these restrictions suit you, when buying a program, you should consider the basic version, and if necessary, basic version at any time you can upgrade to PROF, with an additional payment of the difference in price.

Version CORP convenient for large enterprises, as it supports all the features of the PROF version. Its difference lies in the fact that it has the ability to keep records not only for the enterprise as a whole, but also for its separate divisions, while divisions can be either allocated or not allocated to a separate balance sheet. Between separate divisions with separate balance sheets, the KORP version supports accounting workflow.

Innovations and tricks 3.0: interface

One of the advantages new version is its intuitive interface with simplified navigation and the ability to customize as you wish. Each section of the program is equipped with a navigation bar, and switching between them is carried out with one click.

Rice. 3 The window of the program "1C: Accounting 3.0"

The main sections are not located at the top, but on the left. However, they can be quite easily moved to any other place - click on the arrow in the upper left corner, menu "View-Adjust Panels". Next, in the template, you need to drag the sections panel to any place convenient for you.

Fig.4 Switching to the section panel settings menu

Fig.5 Configuring the placement of panels in the program window

As a result, we have the following window view:

Fig.6 Moving the "Partitions Panel" to the top of the window

Created documents and journals open in separate window, and you can switch between them on the open windows panel.

Fig.7 Panel of open windows

At the same time, we can pin a window or open it next to another window, for which there is a button in the right upper corner.

"Show with another window or pin."

Fig.8 Button "Show with another window or dock"

By clicking on this button, we can arrange two windows side by side.

Fig.9 Configuring the location of windows in the program

So, one of the goals of developing the Taxi interface is to improve navigation through the program. But if you're not used to new interface, you can switch to a more familiar view, for example, as in the programs "1C: Accounting 8" or even "1C: Accounting 7.7". To do this, in the "Tools-Parameters" menu, you need to switch appearance Forms in bookmarks.

Fig.10 Switching to the "Parameters" menu

Fig.11 Window for setting the appearance of the program

After switching the appearance, we have this kind of program.

Fig. 12 The window of the program "1C: Accounting 3.0" - the appearance of "Forms in tabs"

You can also switch the interface "Similar to 1C: Accounting 7.7" in the "Interface" menu, in the "Administration" section.

Fig. 13 Switching the interface "Similar 1C: Accounting 7.7"

The result will be such a type of program, where the menu is presented in the form of sections "Reference books", "Documents", "Reports", "Journals".

Fig. 14 The program window "1C: Accounting 3.0" - an interface similar to 1C: Accounting 7.7

By switching the view - "Forms in bookmarks" we have a different view of the program.

Fig.15 Switching the view of the program "Forms in tabs"

Fig. 16 View of the program "1C: Accounting 7.7" forms in tabs

Favorites, links to objects

Another convenient feature of "1C: Accounting 3.0" is adding items to favorites. The user can add the necessary items to Favorites from the menu, from the form or from the history dialog to speed up access to information. To do this, just mark the element with an asterisk.

Fig.17 Adding an item to favorites

By clicking the "star" in the upper left corner, we go to the list of favorite items.

Fig.18 Favorites section

Now all objects in the database have internal links. Having received such a link, the user can quickly find the object he needs in the database - a document, a directory, etc. To work with links, in the upper right corner are the buttons "Go to the link" and "Get link" or the menu "Tools-Get link", "Go to the link".

Fig. 20 Program menu "Service", working with links

Working with Lists

Another nice innovation of the program is that in lists - in directories or documents, you can perform actions, for example, carry out, cancel the conduct, set and unmark deletion, etc., simultaneously for several elements. To select several lines, use the Ctrl and Shift keys, to select all lines - the combination Ctrl + A. The selected elements are marked in a different color.

Fig.21 An example of selecting and performing an action on a group of objects

Another "bun" from 1C in working with lists is tree structure of the list and conditional formatting, allowing for clarity of the list to display it in the form of a tree and given conditions highlight with color. Consider an example: in the “Accounts” document journal, go to “More-List Settings”.

Fig.22 Document log menu - "List settings"

In the window that opens, on the "Grouping" tab, select the required fields from the available ones, for example, "Counterparty", or if grouped by payment - "Document Status". Click the "Finish editing" button and get the invoices grouped by counterparty.

Fig.23 "List settings" dialog box

Fig. 24 Setting up the list, grouping accounts by counterparty

In addition, there were many innovations that were not in previous versions programs, for example, the ability to fill in or check counterparties by TIN - the “Fill in by TIN” button. In case of an error in filling out the TIN, the program will report this.

Fig. 25 Window of the program "1C: Accounting 3.0", counterparty card, filling in the details

A convenient innovation is the "Documents" tab, where you can display all the documents available in the program with this counterparty.

Fig. 26 Counterparty card, "Documents" tab

For convenient tracking of licenses for alcohol, the tab "Licenses of suppliers of alcoholic products" has been added.

In addition, it became possible to print contracts with details from 1C. For this you need to add new template into the directory "Templates of agreements" and insert the text of the desired agreement, or use any of the existing templates - the menu item "Reference books-Purchases and sales-Templates of agreements".

Fig. 27 Window of the program "1C: Accounting", menu item "References"

Fig. 28 Window of the directory "Templates of agreements"

Fig. 29 Service agreement template

The program also allows you to change other printing forms documents, saving document layouts in user interface. To do this, while in the printed form (“Print” button), go to the “More” button and select the “Change layout” menu. After making the necessary changes, save. In this case, the changes made are saved forever.

Fig.30 Changing the layout of the document

It also became possible to add facsimile printing and painting for automatic substitution into a document in order to immediately send the generated invoice to customers from 1C without printing it or scanning it, and also add the company logo. All this is set in the organization's card - the "Logo and Print" section.

Fig. 31 The window for filling in the details of the organization - setting up the logo, signature and seal

The program has a convenient function and provides a report "Invoices not paid by customers". When posting a payment document, the mark "Paid" or "Partly paid" is automatically put down, and for buyers who have a completed address Email in the organization's card, in the "Address and phone" section, you can send a letter with a reminder about the need to pay the bill.

Fig.32 Filling in the email information

Fig. 33 Window of the program "1C: Accounting", report "Accounts not paid by buyers"

Fig. 34 Report "Invoices not paid by buyers"

By clicking the "Send by e-mail" button in the "More" menu or on the panel at the top, the program will offer to set up an account itself.

Fig.35 Setting account Email

Fig.36 E-mail account setup

To send a reminder to each account separately, you must set the filter for this account when generating the report. When we click the "Send by e-mail" button, the program generates and sends a register of unpaid invoices. By double-clicking on an email address, the program will open a window and send the unpaid invoice in PDF format as an email.

Fig.37 Sending a reminder of unpaid invoices

Functionality setting

"1C: Accounting 8.3" has wider functionality, which can be configured depending on the characteristics of the enterprise. Because the. extra documents and directories make it difficult to find the necessary objects and mislead the user, which can cause accounting errors; to simplify work and eliminate errors in the program, unnecessary functionality can be disabled, leaving only the necessary one. You can do this in the "Administration-Program Settings-Functionality" section.

Fig.38 Program functionality setting section

In the window that opens, you can install one of the three proposed options for functionality - "Basic", "Custom" or "Full", and make settings in the corresponding tabs.

Fig.39 Setting the program functionality

The program has many convenient innovations for filling out documents and generating reports. Completely new documents have appeared. For example, in the payroll section, the ability to generate the documents "Sick Leave", "Executive List", "Vacation" has been added (the function is available if the company employs up to 60 people). The document "Recalculations of insurance premiums" and "Act of verification of insurance premiums when creating these documents" have been added.

Fig.40 Recalculation of insurance premiums

Of the administrative functions in edition 3.0, it is possible to configure user access to the database in the "View Only" mode. This feature is useful for audit and tax audits, while the inspector can independently view all the information he needs, and the accountant will be calm about the safety of the data. This setting is done in the "Configurator" mode, for which a New user with "Read Only" rights.

We examined the useful innovations implemented in the 1C: Accounting 3.0 program, although the main functionality of the program is much wider.

Every accountant at least once in his professional career has faced the need to fill in statistical reports, having got into the so-called "sample" of the statistics body. Many organizations are charged with the constant obligation to provide various forms of statistical observation. In the article, 1C methodologists talk about the possibilities of automatically filling in statistical forms implemented in the 1C: Accounting 8 program (rev. 3.0).

Universal mechanism for setting up filling in statistics forms

At the moment, there are about 200 types of statistical reporting forms, and each form contains an average of 30 or more of the most diverse indicators. Until now, 1C:Enterprise programs have not provided for automatic completion of statistical reporting, although information for most indicators is available in the accounting system. The difficulty lies in the significant difference between the presentation of accounting system data and the data required to fill in statistical forms.

Users of "1C:Accounting 8" (rev. 3.0) got the opportunity to automatically fill in some of the most common forms of statistical reporting.

As of the date of signing the issue for printing, auto-completion of indicators is implemented in the following forms:

- Form No. P-1 "Information on the production and shipment of goods and services", approved. by order of Rosstat dated October 14, 2009 No. 226;

- Annex No. 3 to Form No. P-1 “Information on the volume paid services population by type”, approved. Rosstat Order No. 422 dated July 27, 2012 (to be submitted together with Form No. P-1);

- Form No. P-3 "Information on the financial condition of the organization" ( new form, approved Rosstat Order No. 291 dated July 23, 2013, introduced starting from the report for January 2014).

Why exactly the solution "1C: Accounting 8" turned out to be the most suitable for this task? It's just that a significant amount of economic statistical information is based on data. accounting, only the data is summarized differently.

The indicators required to fill in statistical forms are called “objects of observation”. In order for the user to "bind" the information present in the accounting system to the objects of observation, the program has developed a universal mechanism for setting up the filling of statistical reports.

For the preparation of statistical reporting in "1C: Accounting 8" a group of reports is intended Statistics. You can read about the concept of reporting groups in the reference book “Tools for automated reporting in 1C programs” in the “Reporting” section in IS ITS.

Consider, using the example of filling out Form No. P-1 “Information on the production and shipment of goods and services”, how it is possible, using accounting data, to set up and fill in statistical reporting indicators.

Filling out Form No. P-1

Form No. P-1 is compiled monthly by commercial and non-profit organizations engaged in production and services (except for small businesses, banks, insurance and other financial and credit organizations), the average number of employees of which for the previous year exceeds 15 people, including part-time employees and contracts civil nature.

The form consists of five sections in which you need to specify the following indicators:

- general economic indicators reflecting the production and shipment of goods of own and not own production, industrial and agricultural products, products of an innovative nature and related to nanotechnology, as well as the cost and balances of raw materials, materials and products (Section 1);

- special detailing of proceeds from the sale of goods, works, services of own production in the context of OKVED elements (Section 2);

- wholesale and retail sale of goods, catering turnover and paid services to the population (Section 3);

- transportation of goods and turnover of road transport (Section 4);

- production and shipment by types of products and services in the context of the elements of OKPD and OKEI (Section 5).

As you can see, there are many indicators, they are very diverse and fragmented. Let's see how they get into Form No. P-1 using the new autocomplete service.

Example 1

Completion of line 27 "Turnover of public catering" of Section 3 "Wholesale and retail sale of goods, turnover of public catering, paid services to the population (including VAT, excises and similar obligatory payments)".

If we undertook to fill in this line manually, we would have to allocate the catering turnover for the corresponding period from the entire revenue. We account for catering revenue in a separate Nomenclature group, which is called Dining room. Then, having generated a balance sheet for account 90.01 “Revenue” and setting the selection by subconto in the settings panel Nomenclature group with meaning Dining room, we get the numbers that we need to insert into line 27.

Let's try to automatically fill this line.

In Form No. P-1, press the button filling and select submenu Fill- no miracle happens, line 27 is empty, because first it was necessary to configure the filling of this line. To do this, select the line with the cursor Turnover of public catering, right-click and select Customize padding.

Entering the directory Objects of observation new element - Catering. Adding a selection element Nomenclature group revenue with value Dining room(see fig. Setting up the observation object "Public catering"). Now, after the automatic completion of Form No. P-1, the proceeds from catering services will fall into line 27.

Example 2

Completion of line 12 "Shipment of goods of own production using nanotechnologies" of Section 1 "General economic indicators (excluding VAT, excises and similar obligatory payments)".

To fill in this line, you will need a complex breakdown of revenue:

- firstly, it is necessary to determine which names of nomenclature positions will correspond to the criterion of products, works, services related to nanotechnologies;

- secondly, it is necessary to separate products of own production from purchased goods.

With regard to products of own production, such a selection can be organized using the correspondence of accounting accounts:

Debit 43 Credit 20

But there may be several names of nomenclature items related to nanotechnologies, so it is advisable to place such nomenclature items in a separate group of the Nomenclature directory or keep them in a separate list.

Let's say that at present we produce only one type of product that can be attributed to nanotechnology - this LED bulbs. It is possible that the list of such products will be constantly updated, and this must be remembered.

Using the mechanism for setting up filling in statistics forms, in Form No. P-1, press the button filling and select submenu Tune, find the string , open it.

To the directory Objects of observation we introduce a new element - Products and services of nanotechnology.

We set a complex selection for products of our own production using nanotechnology (see Fig. Setting up the object of observation "Products and services of nanotechnology"):

- the nomenclature position must correspond to the group from the list of values LED lamp;

- item accounting accounts must correspond to the group from the list of values - 43; 20.02.

We press the button filling, submenu Fill, and line 12 of Form No. P-1 will reflect the proceeds from the sale of only LED lamps.

Example 3

Filling in the group of lines 21 "Name" according to the elements of OKVED Section 2 "Shipment of goods of own production, work and services performed on their own for actual activities (excluding VAT, excises and similar obligatory payments)".

Suppose an organization is engaged in logging and forestry, as well as breeding tree seedlings. In Form No. P-1, press the button filling and select submenu Tune, find the string Products and services for individual OKVED, open it.

With button Add we set the selection for each code from the opening OKVED classifier.

We select "Logging" - OKVED 02.01.1 and set Customization.

The simplest option is when the revenue from logging is taken into account in a separate nomenclature group. In this case, it is enough to indicate the name of the nomenclature group in the selection Logging.

However, a situation may well arise when the proceeds from harvesting different parts trees are taken into account in different nomenclature groups. For example, in such as:

- Harvesting branches;

- log harvesting;

- Preparation of stumps.

In this case, you can use the context search and set the following condition: the item name of the revenue must contain the value blank(rice.).

Setting up the object of observation according to the OKVED code

By the same principle, you can organize the revenue setting for forestry and nursery activities. Then, in Section 2 of Form No. P-1, the proceeds from sales will be distributed according to the specified OKVED codes (Fig. Automatic completion Section 2 on OKVED codes).

It should be kept in mind that once the setup is done, it will be suitable for autocompletion in other forms of statistical reporting. For example, the completed setting of the object of observation Catering, which we made for Form No. P-1, will automatically fill in line 27 “Turnover of public catering” of Form No. P-1, as well as line 08 “Turnover of public catering” of Form No. 1-accounting “Accounting for volume retail alcoholic beverages”, approved by the order of Rosstat dated 05.12.2012 No. 628.

New service for autofilling statistical forms

You can configure statistics forms both directly when filling out a specific statistics form, and using the service built into 1C: Accounting 8 (rev. 3.0) Accountant's calendar.

To do this, open the list of taxes and reports by clicking the settings button Calendar, select the desired section forms Statistical reporting, press the button burn and close to save settings Calendar.

After that in Accountant's calendar will appear independent task: Customize filling in statistics forms(see fig. The task of setting up filling in statistics forms in the "Accountant's Calendar").

It will be possible to do Setting up filling in statistics forms both for a separately selected form, and for all available forms at once (Fig.).

Setting up filling in statistics forms

The described mechanism for setting up filling in statistical observation forms provides the user of "1C: Accounting 8" (rev. 3.0) with a universal tool that will allow organizing statistical accounting at the enterprise, taking into account its specifics. However, you need to understand that a responsible and thoughtful approach should be applied to the settings of the objects of observation, then in the future you will not have to return to them, and statistical reporting will be easy to fill out.

With the release of the December releases of "1C: Accounting 8" (rev. 3.0), autocompletion will be supported in the following statistical forms:

- Forms No. P-2 “Information on investments in non-financial assets and funds for shared construction” (approved by orders of Rosstat No. 492 dated September 12, 2012, No. 288 dated July 18, 2013);

- Forms No. P-2 (short) “Information on investments in fixed capital” (approved by orders of Rosstat No. 343 dated 03.08.2011, No. 288 dated 18.07.2013);

- Form No. P-5 (m) "Basic information about the activities of the organization" (approved by orders of Rosstat

The nomenclature in 1C 8.3 means materials, semi-finished products, equipment, services, returnable packaging, overalls, etc. All this data is stored in the "Nomenclature" directory. You can get into it from the section "Reference books", subsection "Goods and services", item "Nomenclature"

You will see a list of directory positions that has a multi-level hierarchical structure.

In this article, we will step by step consider all the instructions for the initial filling of the nomenclature in 1C 8.3 using the example

For the convenience of using this guide, 1C Accounting uses groups (folders). They combine nomenclature that has common features. In each group, in turn, the creation of subgroups is available (similar to file system on the computer). The number of hierarchy levels is set by the programmer, but initially there are no restrictions.

Let's create new group. In the list form of the "Nomenclature" reference book, click on the "Create group" button.

Specify the name created group. You can also fill in its form, but it is not necessary.

As you can see in the figure below, the group we created fit into the "Materials". If it needs to be moved to a different group or to the root, open context menu and select Move to Group. A window will open where you will need to specify a new location.

Creating a new stock item

Let's move on to adding the nomenclature itself. To do this, in the form of a directory list, click on the "Create" button. A card of the new nomenclature will open in front of you.

Fill in the "Name" field. The value in the "Full name" field will be filled in automatically. Please note that the full name is displayed in reports, printed forms of documents, price tags, etc. The “Name” field is used for convenient search nomenclature in the program.

Fill in the rest of the details if necessary:

- The fields "Type of item" and "Included in the group" are filled in automatically from the data of the group in which the new item is created. You can change them if necessary.

- The value in the "Unit" field is the storage unit for the rest of this item.

- The tax rate specified in the requisite “% VAT”, if necessary, can be changed already during the formation of documents.

- "Sales price" is specified by default in sales documents. This setting can be changed by clicking on the hyperlink "?" next to this field.

- In the "Production" section, you can specify the cost item of this stock item, and its specification (for finished products), in other words, composition.

- Depending on the characteristics of the nomenclature, other sections are filled in, such as "Alcoholic products" and "Imported goods".

After you have filled out the card of the item being created, you need to write it down.

What is the type of item in 1C 8.3 and how to set them up

In order to set up types of nomenclature, click on the corresponding hyperlink in the list form of the "Nomenclature" reference book.

Item types are needed to separate item positions. Each type can have its own . It is very important to avoid the presence of duplicates in this reference book, which can lead to incorrect operation of item accounting accounts.

When installing a typical configuration from a supplier, this directory will already be filled with the main types of stock items. If the item type is a service, do not forget to set the appropriate flag when creating it.

Item accounting accounts in 1C 8.3

To generate accounting entries, you need to set up accounting accounts. This can be done from the list form of the reference book "Nomenclature" by clicking on the hyperlink "Nomenclature accounting accounts".

In the standard configuration of 1C Accounting 3.0, this register is already filled out. But if necessary, it can be adjusted manually.

Accounts can be configured:

- for a specific nomenclature position;

- by nomenclature group;

- by type of nomenclature;

- by warehouse;

- by type of warehouse;

- by organization;

- throughout the nomenclature, specifying an empty reference as a value.

If different accounting accounts have been set up for a specific item and for it, then the account will be taken from the item. In such cases, aggregated accounts have a lower priority.

Setting item prices

One item can have multiple prices. They differ in types, such as wholesale price, retail price and so on.

Go to the item card of the "Nomenclature" reference book and follow the "Prices" hyperlink.

A list will open in front of you, in which it is possible for a specific type on a specific date. It is enough to indicate the price in the appropriate column, and then click on the "Record prices" button. The item price setting document will be created automatically, and you will see a link to it in this list.

See also the video about the nomenclature:

In this article I will tell you how to automatically fill out the statistical form P-1 "Information on the production and shipment of goods and services" in the 1C program: Enterprise Accounting 8 edition 3.0. The form is represented by large and medium-sized organizations with more than 15 people.

Consider an example in which the company Servicelog LLC provides services to legal and individuals. In order for the form to be filled out correctly, you need to correctly configure the settings. But before talking about the settings in this case, it is very important to understand how the "Nomenclature" and "Nomenclature groups" directories differ, as well as figure out how to apply them correctly in 1C programs (our article will help you with this " Nomenclature and nomenclature groups in 1C: Enterprise Accounting 8 - how to use it correctly? » ).

In our example, the item group will be called “Services”, and there will also be two names of the item: “Maintenance computer network» (which reflects services legal entities) and "Maintenance of computers" (services to individuals).

Open the tab "Reports", "Regulated reports"

We select the organization and click on the "Create" button, mark the type of report and click "Select".

We select the period for which we will fill out the form, and click the "Create" button.

A blank sheet opens. In order for the form to be filled in automatically, we perform the settings for the lines of interest to us. Click on the "Fill" button and select "Customize"

A window with fill settings opens.

In our example, lines 1.21 and 28 will be filled in. We start from line 01: this line reflects all revenue received from both legal entities and individuals.

We select the observation object "Products and Services" and add a new selection element - by Item Nomenclature Group of Revenue with the value "Services". Now the revenue for all services will fall into line 01.

Then we set up the filling on page 21, in which we must describe our services by type of activity (according to OKVED). In the window that opens, select our type of activity (there may be several) and, just as on page 01, set the setting “Nomenclature group of revenue is equal to services”

If your organization provides services not only to legal entities, but also to individuals, then you must fill out page 28 “Paid services to the population”, which reflects only services provided to the population. When performing this setting, we already set the selection not by the item group, but select a separate item - "Computer Maintenance", since for this item we only reflect the revenue received from individuals.

Now click "Fill" and get the finished report

Our organization does not use freight car, is not engaged in trade and production, therefore we do not fill out sections 4.5. But since we provide paid services to the public (page 28 is completed), we must send Appendix No. 3 to the P-1 form along with the P-1 form.

Appendix No. 3 is filled in the same way. Open the tab "Reports", "Regulated reports", select the desired form and open the filling setting

Just as we set up the filling of line 28 in the P-1 form, we set up the filling in of Appendix 3, the main thing is to choose the “Types of services” correctly so that the form lines are filled in correctly.

Click "OK", click the "Fill" button on title page and get the finished report.

In the example we have considered, the organization provides one type of paid services, therefore, page 28 of the P-1 form must be strictly equal to one of the lines of Appendix No. 3. If your organization provides several types of services, then line 28 will be equal to the sum of the types of services, that is, line 28 of the P-1 form is signed by type of service in the form Appendix No. 3.

To check the completion of sections 1 and 2, we will generate a SALT on account 90 and look at the total revenue data for September and October.

According to the instructions on the form, lines 1 and 21 of the P-1 report are filled out without VAT, line 28 including VAT.

In OSV we see that the revenue for September with VAT amounted to 241,900 rubles, VAT for September: 36,900, that is, revenue without VAT is 205 thousand rubles.

Revenue for October: 125,080 rubles, VAT for October: 19,080 rubles, revenue without VAT: 106 thousand rubles.

Turnovers in OSV coincide with the indicators on pages 01, 21, which means that these lines are filled out correctly.