The main reasons for refusals to register legal entities and individual entrepreneurs under new forms. How the telephone number is written in tax statements Contact numbers are indicated in the corresponding

Read also

It is very common to be rejected for documents submitted to the registrar are printed on both sides of the sheet (two-sided printing). Especially often lawyers publish decisions and protocols on both sides. What is the convenience? And the fact that earlier (until July 4) all the documents that were submitted to the reorgan had to be stapled. And, in order to have less stitching, the protocol was printed on both sides of the sheet. The requirement to staple documents has now been removed, and printing is allowed on only one side of the paper. This requirement is due to the fact that the tax authorities are preparing to scan documents with stream scanners (a pack of paper is placed and the scanner reads them all). Obviously, if there is a two-sided document, then the scanner does not consider it, and the data in the registry will be incomplete, and therefore unreliable. In fairness, it must be said that so far documents are not read by stream scanners, however, duplex printing is denied.

The most common mistake is that the TIN of individuals (applicant, founder, general director) is not indicated. The law regulates that the TIN is required to indicate all individuals who have received a certificate of its assignment. The fact is that the Federal Tax Service notes in its databases the fact of issuing a TIN certificate. And, if the database says that the certificate was issued, then the TIN must be indicated. Unfortunately, in practice, a situation often occurs when a lawyer or accountant prepares documents for registration, and the head answers the question about the TIN that “no, I didn’t receive it.” The manager has no idea that this can lead to refusal, he simply forgot that he received a certificate. By the way, when certificates were just beginning to be issued, it was practiced to issue them to relatives (parents, wives). Former "children" for 14 years that issue a TIN have already grown up, and sometimes they do not even know that their parents received a TIN for them.

1.

A sample of filling out the form P13001 of a new sample

Periodically, each enterprise or organization improves its activities, develops, rationalizes production, because progress never stands still. It is almost impossible to do without transformations in constituent documents. This means that their state registration in the form P13001 is also needed.

- Sheet A contains information about the name of the enterprise or organization. The new name of the company is entered here: full and abbreviated, in Russian. Please note that the former name is indicated in the application.

- Sheet B to be completed when changing the legal address. It is necessary to carefully enter the detailed address of the executive body legal entity, including the index and digital code of the subject of the federation. The two columns of the sheet provide space to fill in the object type and specific name. The order also contains a list of abbreviations. For example, highway - sh, avenue - avenue, lane - lane, etc. As for the words "office", "apartment", "house", their reduction is not provided.

- Sheet B involves changes in the authorized capital: an increase or decrease. Specified new size capital. Particular attention is paid to the reduction of the authorized capital - not only the date of the reduction itself is entered, but also the date of two publications about it.

- Sheets G-Z are filled out simultaneously with the previous sheet and have similar items. The exception is joint-stock companies. Which of these sheets to make changes is determined depending on the subject - participant of the legal entity:

- G - Russian jur. face;

- D - foreign legal. face;

- E - an individual;

- G - Russian Federation, subject of the Russian Federation, municipality;

- Z - a mutual investment fund that owns a share in the authorized capital of a legal entity. faces.

Rules and procedure for filling out the new tax form R14001, download the application form and a sample (example) of document execution in the Russian Federation

For a departing foreign participant is filled sheet G, Where in section 1 put deuce, A section 2 filled in according to an extract from the Register. Sections 3 and 4 skipped.

- change the main view if necessary economic activity in paragraph 1.1. fits in code of the new main foreign economic activity;

- when adding additional OKVED codes, they are listed in paragraph 1.2. placed one after the other horizontally. Same here can be entered the former main FEA, if they want to leave it among the additional ones. At least four digits must be entered for each code.

How to enter the correct phone number on the site

Which of these options is more efficient? Obviously the number on the second site will notice large quantity people than at first. Not only will this save them the hassle of finding a number if they need to contact you, but it will also add weight to your site in their eyes. Try to place the phone number in a conspicuous place, for example, in the header of the site.

Visitors to your site can access it from the very different devices: From computers, smartphones or tablets. In such conditions, the need to copy a number from a site to make a call may seem ridiculous. Don't risk losing leads - make calling your phone number easy. A clickable number will shorten the distance between you and site visitors to one click.

A sample of filling out an application R21001 for registration of IP

1. On page 1 of the application, fill in the last name, first name, patronymic, TIN, gender, date of birth, place of birth and citizenship. TIN and patronymic, if any, are required. If you can't find your TIN or don't remember if you received it, use the "Find out your TIN" service. If you have not received a TIN and the "Find out your TIN" service confirms its absence, then leave the TIN field empty. In the absence of a TIN, it is assigned when registering an individual as an individual entrepreneur, if this person didn't have it before.

Approach the issue of filling out an application for registration of an IP with all responsibility. The new P21001 form is machine-readable, which means that any deviation from the standard may result in refusal of registration. In case of refusal, the application will have to be filled out and resubmitted, as well as the state fee must be paid again.

Order of the Federal Tax Service of January 25, 2012

Order of the Federal Tax Service of January 25, 2012 N ММВ-7-6 / [email protected]

"On approval of forms and requirements for the execution of documents submitted to the registration authority during state registration of legal entities, individual entrepreneurs and peasant (farm) enterprises"

Ministry order Russian Federation on taxes and dues dated December 3, 2003 N BG-3-09 / 664 "On approval of the forms of documents used in the state registration of peasant (farmer) households" (registered by the Ministry of Justice of the Russian Federation on December 24, 2003, registration N 5363, " Russian newspaper", 2004, N 4; Bulletin of normative acts of federal executive bodies, 2004, No. 12);

Computer Literacy with Hope

Simplified The account allows you to receive reference and information services.

To access additional services, upgrade your level account by completing the following fields in your profile:

- FULL NAME;

- floor;

- Date of Birth;

- SNILS;

- passport data.

The data will be verified online (this may take from a few seconds to 5 days), and you will be able to access Additional services: checking traffic police fines, making an appointment with a doctor, registering a trademark and many others

Instead of mail, you can enter your mobile phone number. Wherein mobile phone You should have it at hand, because an SMS with a confirmation code will automatically come to your phone. This code will need to be entered on the State Services website to confirm that you are the owner of the phone.

How to hide a phone number on Avito

Avito is a website for buying, selling, and providing services. Most fast way The connection between the seller and the consumer is the telephone. So the administration of Avito made it mandatory to be indicated in the ad and made it impossible to hide this contact.

I did not find the settings for hiding the phone on the site, so I contacted the support service with these questions. From the answer from Avito, we can conclude that the phone number is required to be filled in and without it, the ad cannot be published, neither in paid access, nor in free.

How to write an ad in Word with tear-off phone numbers

And I have such handwriting that not everyone will read it. Therefore, it is best to make an announcement on a computer. Surely you have a computer or laptop at home, and if not, then you will certainly find it at work. Any of you can simply print an ad, but how to make it attractive and attractive, and most importantly, so that phone numbers do not have to be rewritten.

How to write an ad in Word with tear-off phone numbers? If you need to sell something or offer some services, then for this you need to advertise. We will not talk about ads on Avito and in the newspaper. Let's choose the simplest and most trouble-free way - an announcement on a street board. It takes a long time to write such ads by hand and somehow it is not solid.

14 Jul 2018 183When registering a company and filling out an application for registration, it is required to indicate the phone number of the founder and CEO for the Unified State Register of Legal Entities. This can be either a landline phone (office or a phone number at the place of residence), or a personal mobile.

Often, phone numbers end up on the Internet in open sources, which does not suit many, especially if they indicated during registration personal phone. As a rule, the hosted phone of a personal mobile phone begins to annoy with active calls from companies offering related services for your business, such as: all kinds of programs, furniture, telephony, etc. What to do in this case, change the phone number or make changes to the Unified State Register of Legal Entities?

Changing the company's phone number in the Unified State Register of Legal Entities

To change the phone number in the Unified State Register of Legal Entities, you must go through the standard procedure for making and registering changes, this will require:

- Prepare an application for registration of changes in the form P14001, the applicant will be the current general director. When registering changes in the form P14001, the state fee is not paid, but certification of the document by a notary is a prerequisite.

- Certify the completed form with a notary, because the applicant is the current CEO, then his personal presence is required. You will need to take to the notary the following documents: the current charter, certificate of state registration and certificate of registration, protocol or decision, passport, order for the general director, and most likely an extract from the Unified State Register of Legal Entities will be required, the limitation period of which should be no more than two weeks. If the CEO does not personally submit documents for registration to the tax office, then a notarized power of attorney and a notarized copy for the authorized person will be required.

Necessary documents for changing the phone number of an LLC in the Unified State Register of Legal Entities

Documents for a change in the Unified State Register of Legal Entities must be submitted to the tax office within three working days. For registration, only a certified form P14001 and a power of attorney are submitted if documents are submitted by proxy.

Registration of changes in the tax is carried out within 5 working days, on the sixth working day ready-made documents are issued.

Assistance in preparing documents for changes in the Unified State Register of Legal Entities

The BUKHprofi company carries out all types of changes in the Unified State Register of Legal Entities. The cost of making changes to change the phone number is:

- Notary services: 1,700 rubles. for certification of the form + 2,400 rubles. power of attorney (for submitting and receiving documents without your participation);

- Our services - 5,000 rubles;

- Total - 9,100 rubles.

Declaration 3-NDFL is filled out in the form that was valid in the period when income was received or tax deductions were declared. In particular, when reporting for 2015, use the form approved by Order of the Federal Tax Service of Russia dated December 24, 2014 No. ММВ-7-11/671 .

Filling order

The declaration is filled in the form 3-NDFL according to rules common to all tax returns .

Be sure to include in your declaration:

- title page;

- section 1;

- section 2.

Include other sections and sheets in the declaration as necessary. That is, only if there are income and expenses reflected in these sections (sheets), or the right to receive tax deductions. This is stated in paragraph 2.1 of the Procedure approved by Order of the Federal Tax Service of Russia dated December 24, 2014 No. ММВ-7-11/671.

TIN

Enter your TIN at the top of the form. For an individual entrepreneur, it can be found in the notice of registration as an entrepreneur issued by the Federal Tax Service of Russia upon registration. Citizens can look at the TIN in the certificate of registration of an individual.

Correction number

If you are submitting a regular (first) return this year, put "0--" in the "Adjustment Number" field.

Code of the country

In the "Country code" field, enter the code of the state of which the person submitting the declaration is a citizen. Determine the code yourself using the all-Russian classifier of the countries of the world (OKSM), approved by the State Standard of December 14, 2001 529-ST. For citizens of Russia, enter the code "643". If a person does not have citizenship, indicate the code of the country that issued him an identity document.

In the "Taxpayer category code" field, enter the code in accordance with Appendix No. 1 to the Procedure approved by Order of the Federal Tax Service of Russia dated December 24, 2014 No. ММВ-7-11/671. For an individual entrepreneur, enter "720" in this field, for individuals - "760". Separate codes are provided for notaries, lawyers and heads of peasant (farmer) households.

FULL NAME. and personal data

Last name, first name, patronymic name in full, without abbreviations, as in the passport. It is allowed to write in Latin letters only for foreigners (subclause 6, clause 3.2 of the Procedure approved by order of the Federal Tax Service of Russia dated December 24, 2014 No. ММВ-7-11/671).

At the top of each completed page, indicate the TIN, as well as the last name and initials. TIN must be filled out if the declaration is submitted by the entrepreneur. Individuals may not fill in this field, then they will have to indicate passport data (clause 1.10 and subclause 7 clause 3.2 of the Procedure approved by order of the Federal Tax Service of Russia dated December 24, 2014 No. MMV-7-11 / 671).

Taxpayer status

In this field you need to indicate whether the citizen is or Russian Federation.

If a citizen has been in Russia for more than 183 calendar days in the last 12 months, then he is a resident. In this case, indicate the number 1. If less - the number 2. Read in the article .

Residence

In the "Taxpayer's place of residence" field, enter the number 1 if you have a residence permit in Russia. If there is no registration, but there is registration at the place of residence, indicate the number 2.

Indicate the index, district, city, settlement, street, house number, building and apartment on the basis of the entry in the passport or certificate of registration at the place of residence. If there is no place of residence, indicate the address of registration at the place of residence. Take it from the certificate of registration at the place of residence.

Enter the region code in the Region field. You can determine it using Appendix 3 to the Procedure approved by Order of the Federal Tax Service of Russia dated December 24, 2014 No. ММВ-7-11/671.

Such rules are established by subparagraph 9 of paragraph 3.2 of the Procedure approved by order of the Federal Tax Service of Russia dated December 24, 2014 No. ММВ-7-11/671.

The field "Address of residence outside the territory of the Russian Federation" is filled in only .

Contact phone number

Write the contact phone number in full, with the area code. This can be either a landline or a mobile number. The phone number should not contain spaces or dashes, but brackets and a + sign can be used to indicate the code (subclause 11 clause 3.2 of the Procedure approved by order of the Federal Tax Service of Russia dated December 24, 2014 No. ММВ-7-11 / 671).

Sheet A

Start filling out totals from sheet A, which indicates income received from sources in Russia. At the same time, do not indicate income from entrepreneurial and advocacy activities, as well as from private practice, in sheet A, such income is reflected in sheet B.

Fill in the indicators on sheet A separately for each source of income payment and for each tax rate. For income under an employment or civil law contract, take them from the certificate in the form 2-NDFL.

By line 010 indicate the tax rate at which the income was taxed.

By line 020 Enter the code for the type of income. These codes are given in Appendix 4 to the Procedure approved by Order of the Federal Tax Service of Russia dated December 24, 2014 No. ММВ-7-11/671. For example, for income under an employment contract (in other words, salaries), put the code "06".

By line 030 enter the TIN of the organization that paid the income. When receiving income from an entrepreneur, enter his TIN.

By line 040 indicate the KPP of the organization that paid the income. When receiving income from an entrepreneur, put dashes.

By line 050 indicate OKTMO of the organization from which the income was received.

By line 060 indicate the name of the organization that paid the income. If you received income from an individual, then enter his last name, first name, patronymic and TIN (if any).

By line 070 reflect the amount of income received in the year for which you fill out the declaration.

By line 080 indicate the amount of income on which you need to pay tax (tax base).

By line 090 reflect the amount of the calculated tax. You get it by multiplying the tax base ( line 080) on tax rate indicated above in line 010.

If all sources of income do not fit on one page, then fill out as many sheets A as you need (clause 6.2 of the Procedure approved by order of the Federal Tax Service of Russia dated December 24, 2014 No. ММВ-7-11 / 671).

Sheet B

The exchange rate of the Bank of Russia for the US dollar on the date of payment of dividends and tax amounted to 40.5304 rubles / USD (conditionally).

In Russia in 2015, such income was subject to personal income tax at a rate of 9 percent (clause 4, article 224 of the Tax Code of the Russian Federation). Not later than April 30, 2016, Kondratiev must submit a declaration in the form 3-NDFL to the tax office at his place of residence (subclause 3, clause 1, article 228, clause 1, article 229 of the Tax Code of the Russian Federation).

The organization in which Kondratiev works, withheld the entire amount of personal income tax from his salary and transferred it to the budget in full. Therefore, he decided not to indicate these incomes in the form of wages in the declaration. Paragraph 4 of Article 229 of the Tax Code of the Russian Federation gives him such a right.

When filling out sheet B of the declaration, Kondratiev indicated:

- on line 010 - country code - 840 according to OKSM;

- on line 020 - the name of the organization, using the letters of the Latin alphabet, - HOLDING LIMITED;

- on line 030 - currency code - 840 according to the All-Russian Classifier of Currencies;

- on line 040 - the date of receipt of income - 10/15/2015;

– on line 050 – the US dollar/ruble exchange rate set by the Bank of Russia on October 15, 2015 – 40.5304 rubles/USD;

- on line 060 - the amount of income in US dollars - 625 US dollars;

- on line 070 - the amount of income in terms of rubles - 25,331.5 rubles. (625 USD × 40.5304 RUB/USD);

- on line 080 - the date of tax payment - 10/15/2015;

– on line 090 – the US dollar/ruble exchange rate set by the Bank of Russia on October 15, 2015 – 40.5304 rubles/USD;

- on line 100 - the amount of tax paid in US dollars - 62.5 US dollars (625 USD × 10%);

- on line 110 - the amount of tax paid in the United States, in terms of rubles - 2533 rubles. (62.5 USD × 40.5304 RUB/USD);

- on line 120 - the amount of tax accrued in Russia at a rate of 9 percent - 2280 rubles. (25,331.5 rubles × 9%);

- on line 130 - the amount of tax to be offset - 2280 rubles. (2280 rub.< 2533,15 руб.).

On February 12, 2015, Kondratiev submitted a declaration in the form 3-NDFL to the residence inspectorate.

Together with the declaration, Kondratyev submitted to the inspection a document on the income received and on the payment of tax by him outside of Russia, confirmed by the US tax authority.

Sheet B

Fill in sheet B only if you are an entrepreneur, lawyer, notary, arbitration manager or head of a peasant (farm) economy.

For each activity, complete separate sheet IN.

In paragraph 1 on line 010 select the type of activity. If a citizen carries out several types of activities at once (for example, he is simultaneously an arbitration manager and an individual entrepreneur), then such income must be reflected separately. That is, for each type of activity, fill out a separate sheet B.

By line 020 indicate the code of the type of entrepreneurial activity of the entrepreneur. This code can be found in the extract from the USRIP, which is issued by the Federal Tax Service of Russia, in its absence, you can determine the code yourself using the resolution of the State Standard of Russia dated November 6, 2001 No. 454-st. Lawyers, notaries and arbitration managers put dashes in this field

In paragraph 2 on lines 030–060 indicate the amounts of income and expenses on the basis of primary documents or the book of accounting for income and expenses, approved by order of August 13, 2002 of the Ministry of Finance of Russia No. 86n and the Ministry of Taxes of Russia No. BG-3-04 / 430.

By lines 070–080 give the amounts paid to individuals on the basis of employment contracts that were in force in the reporting year.

Line 100 fill in only if there are no documented expenses. Specify the amount of expenses that is taken into account according to the standard. To do this, the total amount of income ( line 030) must be multiplied by 20 percent (clause 8.3 of the Procedure approved by order of the Federal Tax Service of Russia dated December 24, 2014 No. ММВ-7-11/671).

In paragraph 3 on line 110 Enter your total income. To do this, you need to add up the indicators of all lines 030 one type of activity.

By line 120 reflect the amount of the professional tax deduction. To do this, add up the scores lines 040 for the specified type of activity.

By line 130 indicate the amount of accrued advance payments. Take it from the tax notice, which should be sent by the Federal Tax Service of Russia.

By line 140 indicate the amount of advance payments made. You can view this amount in the payment order (clause 8.4 of the Procedure approved by order of the Federal Tax Service of Russia dated December 24, 2014 No. ММВ-7-11/671).

If several sheets B are filled out, calculate the total data on the last of them. Such rules are established in clause 8.1 of the Procedure approved by Order of the Federal Tax Service of Russia dated December 24, 2014 No. ММВ-7-11/671.

Lines 150–160 are filled exclusively by the heads of peasant (farmer) households.

Clause 5 is filled out only by entrepreneurs who participated in controlled transactions, independently adjusted the tax base and want to pay additional tax (clause 6, article 105.3 of the Tax Code of the Russian Federation).

Sheet E1

In sheet E1, calculate the amount standard And social deductions that may be granted in accordance with Articles 218 and 219 of the Tax Code of the Russian Federation.

By line 010 indicate the amount of standard deductions established by subparagraph 1 of paragraph 1 of Article 218 of the Tax Code of the Russian Federation (3,000 rubles per month).

By line 020 indicate the amount of standard deductions established by subparagraph 2 of paragraph 1 of Article 218 of the Tax Code of the Russian Federation (500 rubles per month).

By line 030 note how many months the income of a citizen did not exceed 280,000 rubles. This indicator is important for calculating the deduction for children, since it is provided until the month in which income exceeds this amount.

By lines 040–070 reflect the amount of standard deductions for children provided for various reasons.

By line 080 Calculate the total amount of standard deductions (sum lines 010–070).

By line 090 indicate the amount of donations. This amount should not exceed 25 percent of the total income. This expense can be confirmed on the basis of an agreement with the organization that receives donations, payment orders and other documents.

By line 100 you can reflect the amount paid for tuition, but not more than 50,000 rubles. in a year. Tuition fees can be determined on the basis of an agreement with an educational institution and payment documents.

By line 110 indicate the amount of expenses spent on treatment. You can confirm such expenses on the basis of an agreement with the institution, a certificate of payment for services and other payment documents. At the same time, the total amount of the social tax deduction for the year for education, treatment, non-state pension provision, the funded part of the labor pension and voluntary life insurance should not exceed 120,000 rubles.

By line 120 enter the total amount of expenses, to do this, add lines 090–110.

By line 130 indicate the expenses of a citizen for:

- own training;

- full-time education of his brother or sister until the age of 24.

By line 140 reflect the costs of treatment and the purchase of medicines.

By line 150 indicate the costs of voluntary life insurance (assuming that the contract is concluded for a period of at least five years).

By line 160 indicate the costs of voluntary pension insurance (non-state pension provision).

Line 170- final according to item 3 of sheet E1. In it, indicate the amount of social deductions for lines 130–160.

By line 171- indicate the total amount of social tax deductions provided in the tax period by tax agents.

By line 180– enter the total amount of social tax deductions. Determine it by subtracting the value in line 171 of sheet E1 from the sum of the values of lines 120 and 170 of sheet E1.

By line 190 indicate the total amount of all standard and social deductions on the declaration. Determine by summing the values of lines 080 and 180 of sheet E1.

The most common mistake is that the TIN of individuals (applicant, founder, general director) is not indicated. The law regulates that the TIN is required to indicate all individuals who have received a certificate of its assignment. The fact is that the Federal Tax Service notes in its databases the fact of issuing a TIN certificate. And, if the database says that the certificate was issued, then the TIN must be indicated. Unfortunately, in practice, a situation often occurs when a lawyer or accountant prepares documents for registration, and the head answers the question about the TIN that “no, I didn’t receive it.” The manager has no idea that this can lead to refusal, he simply forgot that he received a certificate. By the way, when certificates were just beginning to be issued, it was practiced to issue them to relatives (parents, wives). Former "children" for 14 years that they issue a TIN have already grown up, and sometimes they do not even know that their parents received a TIN for them.

What to do in such a situation? First, I suggest checking if you have been assigned a TIN. This is easy to do through the corresponding online service of the Federal Tax Service of Russia. If the program shows your TIN, I recommend that you put it in the application for state registration. If you cannot find your TIN, then I recommend contacting the Federal Tax Service of Russia at the place of residence and getting a certificate in your hands. This is easy to do: first you come with a passport to the district tax office at the place of registration, take a ticket (the wait usually takes from 2 to 20 minutes), and fill out a request for a certificate with the inspector; after three to five working days (officially - five, but sometimes they verbally report that they can do it earlier), you come to the tax office and pick up the finished document. You don't need to pay for anything.

Another common mistake is to indicate the OKVED code with three characters. In the old forms there was a special indication that the OKVED code must be indicated at least three characters, everyone is used to this rule, and since July 4 the rules have changed, and the OKVED code must now be indicated at least four characters. The tax authorities motivate the need for this change by the fact that information in this format is required by the PFR and the FSS of the Russian Federation. However, in practice, none of the funds regulated the number of OKVED characters for accountants, and they always indicated three, and that was enough. However, the rule of four characters is spelled out in the official ones, and it must be observed (Fig. 1).

Rice. 1. A sample of filling in the indicator code according to OKVED

Also tightened the rules regarding the indication of the phone number and E-mail of the applicant. Let me remind you that in accordance with clause 2.20.4, the applicant's phone number is required to be indicated in any case! A email address- in the case of sending documents via the Internet (for example, through a notary or through a single portal of public services). In previous versions of forms, fillers were used to the fact that a phone number was optional, and sometimes lawyers argue that "not everyone has a phone number." In my opinion, if an individual has a home number, or has a mobile number registered to this individual, then the excuse that there is no phone number will not work, either in the tax office or in court. I suppose that the small peoples of the Far North may not have a phone number, there is nowhere to put towers there, but they are unlikely to need to create a company either. And if necessary, I'm sure an exception will be made for such a person.

What other mistakes are usually made in documents submitted for state registration?

- When writing a name that is transferred to the second line, do not put a space at the beginning of the line, if necessary (Fig. 2);

Rice. 2. Samples of writing the name of a legal entity

- fill out the application in NOT CAPITAL letters;

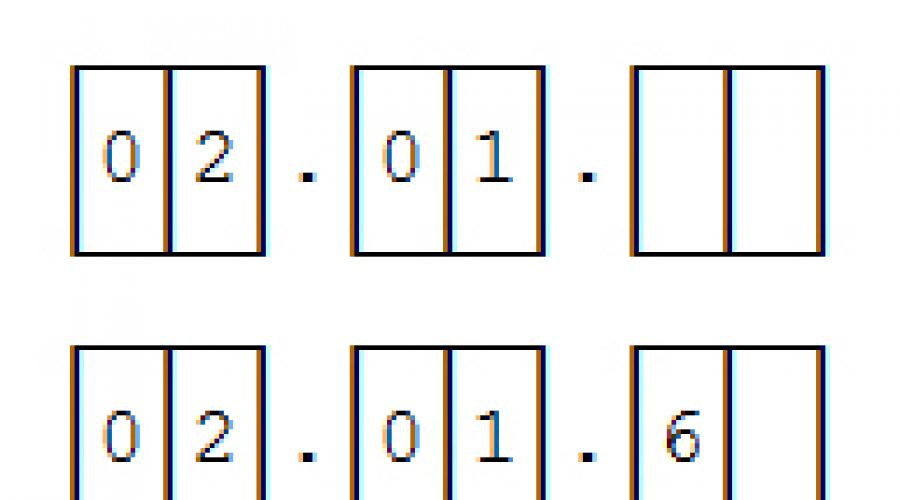

- do not follow the phone number format (Fig. 3);

Rice. 3. Samples of filling in landline and mobile phone numbers

- do not fill in the required sections;

- fill in the extra sections.

Documents printed incorrectly

It is very common to be rejected for documents submitted to the registrar are printed on both sides of the sheet (two-sided printing). Especially often lawyers publish decisions and protocols on both sides. What is the convenience? And the fact that earlier (until July 4) all the documents that were submitted to the reorgan had to be stapled. And, in order to have less stitching, the protocol was printed on both sides of the sheet. The requirement to staple documents has now been removed, and printing is allowed on only one side of the paper. This requirement is due to the fact that the tax authorities are preparing to scan documents with stream scanners (a pack of paper is placed and the scanner reads them all). Obviously, if there is a two-sided document, then the scanner does not consider it, and the data in the registry will be incomplete, and therefore unreliable. In fairness, it must be said that so far documents are not read by stream scanners, however, duplex printing is denied.

Non-obvious failures

Unfortunately, the Requirements turned out to be not ideal - they contain errors that the Federal Tax Service of Russia has already recognized, and do not regulate some situations. So, for example, a lot of people got rejected because did not put down "0" in sheet "З", which is filled in in case of withdrawal of a participant from the company and the distribution of this share among the participants, or the sale of this share.

The history of this situation is such that at first it was not necessary to put "0". That is how they verbally explained in the Federal Tax Service of Russia. And the program for the formation of documents used in the state registration of the FDGR, which is being developed by the State Research and Development Center for filling out applications for registration, also did not set "0". The first documents came out, and a wave of refusals rolled! The people were perplexed.

I made a written request to the Federal Tax Service of Russia via an Internet appeal, and I received a response. In the Letter of the Federal Tax Service ND-3-14 / [email protected] dated August 19, 2013, the Federal Tax Service of Russia clarified that "0" should be put in the corresponding field of this sheet.

Unexpected failures

And quite recently, we had such a case when one of the lawyers was denied registration of a legal entity on the basis that the acting notary was not listed in the federal database of notaries. This is the first time we have encountered the fact that the tax office checks the authority of the person who certified the application. The notary who certified that statement is one of the most famous notaries in Moscow, he has always been in good standing, and it would be extremely difficult to guess that something would be wrong with him. But either the notary did not have time to submit information about his new temporary agency to the federal database, or they did not extend their powers in time, but the fact remains that a statement certified by an unauthorized person is considered incorrect, and therefore not submitted.

The catch is that the applicants do not have legal access to the federal database of notaries and their interim. You can check the powers of a notary or his temporary acting office at a notary office by asking the person who certified (or certifies) the application a copy of the license for the right to notarial activity and a copy of the order of the justice authorities. You can also use the online service of the notaries information portal, bearing in mind that the database of notaries available on this information portal is not the official federal database of the Federal Tax Service of Russia and will not necessarily coincide with it.

Refusals due to legal addresses

Refusals due to incorrect indication of the address of the location of the legal entity. Thus, the Federal Tax Service of Russia is trying to deal with one-day firms. They exist to this day, the sellers of "entrance legal addresses" earn on the sale of "air", the business once again curses both of them. Here is a list of possible failures for incorrect location addresses:

- By specified address there is no real estate object (for example, the house was demolished);

- the owner did not confirm the provision of the address;

- there is a "registration ban" on the address (the owner wrote a letter to the Federal Tax Service with a request not to register at his address);

- the company is not located at the legal address (the representative of the Federal Tax Service left, there is no sign on the address);

- the address is not in KLADR / SOUN (in the database of the Federal Tax Service of Russia, for example, a new building).

What advice can be given here? It is best to register at the real, actual address where the company will be located - this is the most reliable option. And if this is not possible, carefully check the address, the seller of this address and the owner who provides the address, if there are any bad reviews about them on the Internet.

In conclusion, I would like to say that most of the refusals that applicants receive are due to mistakes and inattention of the applicants themselves. There are so few so-called "illegal" refusals from the Federal Tax Service of Russia that it is quite within the framework of the human factor. It is worth noting that the Federal Tax Service of Russia began to work much better and more client-oriented, especially its central office and Moscow tax offices. Let's hope that positive changes will surely come to all regions, and the Federal Tax Service of Russia will move from the category of "opponent" to the category of "assistant", at least in the field of company registration.

Instruction

You can use the notation standard phone numbers adopted in Russia. First enter your code. The code of Russia and Kazakhstan is 7, the code of Ukraine is 380, the code of the Republic of Belarus is 375. The country code is written with a “+” sign and, for a call from a mobile phone, it is dialed. For international call co landline phone dial 8-10-country code.

Then write your city code or area code if you live in a small town. For mobile, enter the code mobile operator. The code is written with a space, without brackets and hyphens. You can look up the telephone codes in the telephone directory or on the Internet at reference sites.

There is no exact standard for recording telephone numbers in the world. In other countries, the phone number format may differ. Spaces can be used instead of hyphens: XXX XX XX. In France, periods can be used as a separator: +33.ХХХХХХХХ. In the United States, this form of recording is accepted: +1 (XXX) XXX-XXXX. The city or region code is separated parentheses, and the intrazone number is divided into two parts. For example, in this format you need to specify your phone number when registering on the Microsoft website.

By entering your phone number for registration on a foreign site, you may receive a message that the number is written incorrectly. In this case, when writing, be guided by the pattern that is usually given.

Related videos

Sources:

- international phone

There are several ways to call another country: use a landline phone, a phone card, a mobile phone, or, for example, Skype. Consider the option of how to dial international number a resident of Russia from a landline phone.

Instruction

Dial "10" - international service entry index.

Here is how, for example, you can call from Russia to Finland in the city of Joensuu. The code for Finland is 358, the area code for Joensuu is 13.

So, we dial: 8-10-358-13-city phone number in Joensuu.

note

It takes a few seconds to establish a connection. The duration of the conversation starts to be recorded automatically from the moment your subscriber answers.

In some countries, there is no area code, therefore, immediately after the country code, immediately dial the subscriber's number.

Sources:

- Phone cards, website

- Set rule cell number to call from Ukraine to Russia

If you cannot find what you need software for your phone or just have a few ideas for developing a new one, you can write a mobile application yourself. You can also create games.

You will need

- - Nokia SDK or J2SE and J2ME Wireless Toolkit.

Instruction

Download the software you need to write applications to your computer. You can use any programs that are convenient for you to use. You will need a compiler that creates archives mobile applications, emulators for testing, text editor or any other program that will be convenient for writing code.

Your best bet is to use the J2SE compiler and the J2ME Wireless Toolkit. There are also special programs, combining this functionality in one installer, for example, Nokia SDK. To create a project, it is best to immediately select the program that you will use in the future, because you get used to one. It will be difficult to rebuild to another in the absence of the necessary functionality in it.

Create a new project in your editor, give it a name and other necessary attributes. Write software code for a mobile device, testing it alternately with different phone emulators to check for bugs.

After you edit the program code, after checking, pack it into jar and jad archives, then save the file to HDD your computer. Copy setup file to your phone, if necessary, also use it to check the functionality of the software you wrote for mobile devices.

If you want the software you write to be available for download on the Internet, host it on a specific portal. You can either provide it for free use or assign a certain amount for downloads, however, in the second case, you will have to choose a special resource that supports this function.

Related videos

Helpful advice

When writing code, also use special editors, it is much more convenient than a regular notepad.

The telephone has long become a familiar and mass means of communication. With the advent mobile devices there are new rules for dialing telephone numbers that you need to know to successfully make calls.

You should dial the area code if you are calling home phone located in another city. It doesn't matter if you call from cell phone or from home. To find out the telephone code of a particular city you need, use the telephone directory or enter the appropriate query into the search bar of your browser.

In addition, in some cases, dialing the area code is necessary to call any of the emergency services. It depends on the dialing rules of this kind, entered by the operator of your cellular network. For example, to call the ambulance service from a phone connected to the MTS network, you need to dial the following number: 8 (international prefix) - area code - 03 (ambulance phone) - 111.

You do not need to dial the area code if you are calling from your home to a mobile phone of a subscriber located anywhere in the world. Also, you will not need an area code even if you make a call from your home phone to the same home phone located within your city.

If you have any problems dialing phone numbers, contact your operator help desk the network that serves you. Remember that calling another city on your home phone without dialing the landline area code, it is forbidden.

A good assistant program for finding the necessary phone numbers and codes of different cities is the 2GIS telephone directory. It has a detailed telephone database for different cities of Russia and many additional features(various maps, contacts of organizations, etc.). 2GIS can be downloaded and installed on a computer or mobile phone, it supports Android platforms, Windows Mobile and Symbian. The guide can also be used online.

Sources:

- Russian city codes