My business is a review of an accounting service. Internet accounting “My Business” - real help in business development

Small, medium-sized and even sometimes large enterprises need help in organizing accounting and receiving services related to this process: audit, specialist consultations, verification of counterparties, etc.

Let's look at the “My Business” service, which offers its users an integrated approach to accounting and provides other additional services.

What it is

Internet accounting “My Business” (LINK) has been operating since 2009. During the first year, several thousand free and more than 1,000 paid users registered. Year after year, the service expanded and provided its users with more and more new services.

It works on the SaaS principle, which means that users use services via the Internet. It works in two versions: for professional accountants and for the most ordinary users who often know nothing about accounting.

Video - review of the online online accounting service “My Business”:

Thus, the first version of the service (“My Business. BUREAU”) provides users with the opportunity to solve any accounting problem and more.

The service has implemented the Internet banking systems of many large Russian banks (Promsvyazbank, Alfa-Bank, Tinkoff Bank, and more recently Sberbank and others).

What services does online accounting “Moye Delo” provide?

Let's look at the services provided by the service in more detail.

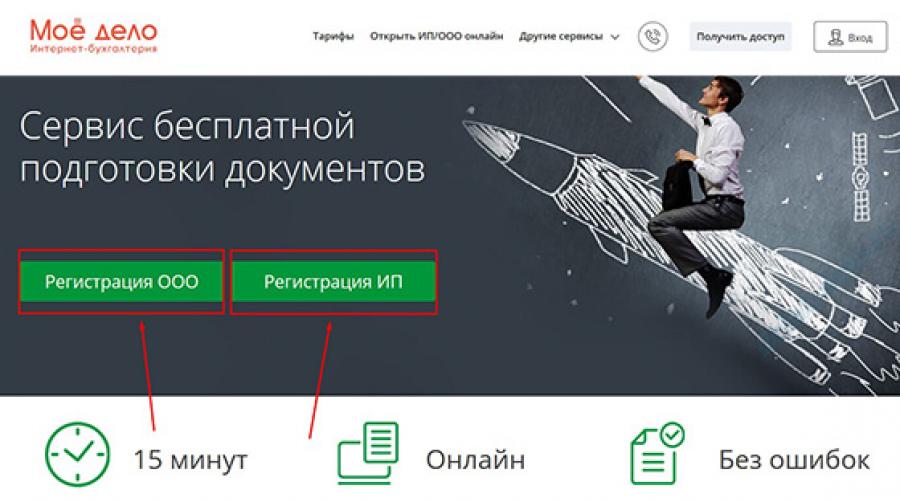

Assistance with registering LLCs and individual entrepreneurs

If you are registering as an individual entrepreneur for the first time or opening a company, you can easily get confused with the algorithm of actions and filling out documents. Internet accounting "My Business" offers free help when registering an individual entrepreneur or LLC.

How it works? Everything is extremely simple:

- Go to the “My Business” service page for free preparation of documents for registration of an individual entrepreneur or LLC - LINK. And choose the package of documents you need (LLC or individual entrepreneur).

- Register in the service by filling out several form fields:

- Step by step fill in all the necessary fields for the program to generate documents. Don't worry, there are hints waiting for you at all stages of filling out.

- Print out the documents. After you enter all the data, the service will automatically prepare all documents in accordance with the latest requirements of Russian legislation. A barcode is applied to the documents, and at the end of processing the document is checked according to the Federal Tax Service directory.

- In addition to the fact that the “My Business” service will prepare all the necessary documents for you for free, you will receive step by step guide for further actions, including also the address of the tax office closest to you.

Accounting

Now there are many offers from various outsourcing companies to serve entrepreneurs, however, not everyone can afford them. “My Business” is a service that offers services to individual entrepreneurs and LLCs at an affordable cost. To do accounting using My Business, you don’t need any special education or skills—in most cases, you just need to fill out the required fields according to the prompts.

Video - how to issue an invoice to a client:

The service is updated online and therefore it always reflects all changes in legislation. With this service you can:

- create invoices and postings;

- maintain registers;

- take into account income and expenses;

- calculate salary;

- calculate taxes and insurance premiums;

- generate reports;

- … etc.

By the way, submitting reports to the Federal Tax Service will also become easier, because Through the service you can send documents via the Internet. Moreover, clients of the service always have the opportunity to consult with experts in the field of accounting and taxation.

If your company has entered into a significant document flow, then it may make sense to consider another offer from “My Business” - full accounting services. Watch the video presentation of this service:

“My business. BUREAU: service for checking counterparties

Checking your counterparties will help confirm that you are working with reliable companies. Using the service for checking counterparties “My Business. Bureau" you will be able to determine the status of the counterparty, as well as check the registration data of the company or individual entrepreneur and receive an extract from the Unified State Register of Legal Entities. Moreover, the service will help you find errors if they were made in the company details.

Verification and in order to receive an extract from the Unified State Register of Legal Entities or check registration data, be sure to check the TIN and KPP of the counterparty you are interested in.

The service also helps to determine how likely the tax inspectorate or Rospotrebnadzor is to come to you.

Functional evaluation

Both individual entrepreneurs and LLCs can work in online accounting “My Business”. In the first case, it does not matter at all whether the individual entrepreneur has employees or not. If, for example, an individual entrepreneur does not have employees, then he can use the very first tariff called “Without employees,” which provides basic functions.

The service provides enough opportunities for full personnel records: for example, in order to create detailed profiles of employees, keep track of who was hired and who managed to quit, and also take into account all employees who work remotely.

The tax accounting system is also well organized. With the help of online accounting “My Business” you can remotely (via the Internet) and also make tax calculations, for example, personal income tax. The service is based on cloud technologies, which means your data will never be lost.

The functionality also includes such sections as warehouse accounting and cash accounting. The functions are minimal, but they are all necessary. Payroll calculation is another large section of the service. You can calculate all types of employee contributions (salaries, advances, bonuses, travel allowances, etc.).

Internet accounting “My Business” also provides samples of all the basic documents that entrepreneurs may need. So, you can use ready-made forms: contracts, bills, invoices, acts, accounting certificates, orders, etc.

If we compare “My Business” with other services, its functionality is approximately on par with the most popular programs for accounting and tax accounting. The undoubted advantage of the service is the availability of sample forms - no other service can offer such a variety.

Tariffs "My business"

For LLCs and individual entrepreneurs there are 4 tariffs available to choose from: “Without employees”, “Up to 5 employees”, “Maximum” and “Personal accountant”.

Let's look at each in more detail.

| "No employees" | "Up to 5 employees" | "Maximum" | "Personal accountant" |

| You can conduct taxes, generate reports, prepare invoices and primary documents, and maintain warehouse records. Full access to consultation with experts. Cost 833 rub. per month. | You can conduct taxes, generate reports, prepare invoices and primary documents, and maintain warehouse records. Full access to consultation with experts. Employee accounting is also available (up to 5 people). Cost 1624 rub. per month. | You can conduct taxes, generate reports, prepare invoices and primary documents, and maintain warehouse records. Full access to consultation with experts. Work taking into account employees (up to 100 people). Cost 2083 rub. per month. | You can conduct taxes, generate reports, prepare invoices and primary documents, and maintain warehouse records. Full access to consultation with experts. The number of employees to be registered is unlimited. Reconciliations and verifications of counterparties are available, as well as special service on optimization of tax accounting. Cost 3,500 rub. per month. |

As you can see, rates largely depend on how many employees there are in your individual entrepreneur or LLC. The most popular tariff for LLCs is “Maximum”, and for individual entrepreneurs – “Without employees”, since individual entrepreneurs are most often beginners, work alone and prefer to do their own accounting.

Grade: 5

I opened my own individual entrepreneur six months ago, I planned that I would do all the accounting myself, but I was constantly torn between all sorts of bureaucratic tasks and the desire to devote all my time to business development. IN certain moment I finally realized that time is not rubber, and I am not a super person, so I chose online accounting My Business. Cheap, cheerful and saves me a lot of time))) Good service, which I can confidently recommend to those who want to keep their finger on the pulse of their business, thanks to My Business.

Grade: 5

I myself live in small town, and we have a problem finding a good accountant - I would be happy to pay a specialist a salary, but I don’t want to just give money for something I can do myself. And then you’ll have to tremble during tax audits and wait for fines. Therefore, the My Business service became a real godsend for me - I tested it first for three days, then they gave me two weeks of free use, and I realized that this is what I need. I outsourced my accounting to a company, and now I know that my company is handled by professionals. If any questions arise, I can always contact the consultants - an answer is guaranteed within 24 hours.

Grade: 5

I have been using the “My Business” service for four months now - this time was enough to form an opinion about the company. By the way, the opinion formed was good. With them I save a lot of my time - most of the work in the field of accounting is now automated - accounts, primary documentation, taxes, reporting, etc. I contacted the company’s managers a couple of times for advice - they gave comprehensive answers to my questions with links to laws and articles of legislation of the Russian Federation. So there is a little time left for yourself.

Grade: 5

The service helps well when running a small business. I've been using it for 5 years and it has never let me down. When I started, I calmly figured everything out, now I do everything automatically. The tariff is the cheapest, there is no one on staff, no one needs to take out sick leave/vacation leave. Cleanly process income/expenses, calculate taxes, write out various documents, remake contract templates for yourself, etc. All in convenient interface. During the entire period of use, there have never been any inspections, all taxes are paid on time, the authorities have no complaints. The price may not be the cheapest, especially now when dozens of analogues have appeared, but I don’t change it for 2 reasons:

1) I completely trust here, the quality is time-tested; 2) during the test periods it is clear that the functionality I need from analogues will be more expensive than here, and I don’t see the point in overpaying

Grade: 4

Without accountant skills (or at least an idea of how everything works), using the service is not as easy as it might seem. Plus, there are errors in it: in particular, according to the universal transfer document for sale, VAT on the buyer’s advance payment is not deducted. This leads to incorrect filing of the VAT return, and as a result – excessive payments of taxes to the budget. How does support react to such problems in the system: they suggest creating a receipt invoice (act), and not a universal transfer document. Despite the fact that I do not accept (i.e. it is not an admission that is being processed), but I implement it. In other words, the so-called experts do not really understand the topic. Otherwise, as far as the most common operations are concerned, everything is in order. At least it works stably and you don’t have to constantly update the data and wait until everything goes away. And yes, 1C is much simpler. Even if, in total, that program will be, as it seems to me, more functional, for ordinary entrepreneurs online accounting from “My Business” is better. At least if you don’t want to spend money on an accountant.

Grade: 4

The main advantage of online accounting is that you do not need to hire a real accountant for the company or outsource it. The service is much more economical. Less than 20 thousand is spent per year, this is the average salary of an accountant per month in the region. But you'll have to figure it out on your own. Of course, you don’t need to master accounting from cover to cover. But you need to know the basics. In principle, this way you understand your business even better.

The cost of the service can be adjusted to suit you. The difference in tariffs mainly depends on the size of the company where the service is being implemented. The cheapest option is for an individual entrepreneur without employees, I have a tariff for up to 5 employees (can be used by legal entities). You need to buy for a year at once, there is no monthly fee. The functionality is rich. Firstly, it calculates all taxes and contributions for employees. They are also counted as personnel and I calculate their salaries. Secondly, it helps with reports and their submission. I have an electronic signature, which means I send reports electronically directly from my personal account.

Thirdly, all work with documents is in the interface. Indeed, everything I ever needed: invoices, closing documents, various contracts (there are a bunch of templates in the database) and much more. The service also synchronizes with the bank. There is practically nothing to criticize the service for. Subjectively, I can only criticize the interface. But here it depends, I personally find it inconvenient. If you could customize your office, remove unnecessary blocks, add widgets, etc., it would be much more convenient. And it’s just a bunch of tabs. But over time you get used to it, I don’t even notice it anymore.

Well, support. She works around the clock, she has contacted me more than once even with the most stupid questions, and they always answer. But as it happens, if it’s a busy period (end of the year, quarter), when everyone is submitting reports, then the girls from the support are tired and weak in making contact, and don’t try to understand the problem. As a person, I understand them, but as a specialist, they must also work. And some still have doubts about their competence.

Grade: 5

I lead individual entrepreneurs through My Business. In principle, the business started with this service, and did not move to it with a ready-made business. To open an individual entrepreneur I was able to prepare all the necessary documents. Everything is written in detail about what is needed, what to fill out, etc. There is no need to search on the Internet or run to the tax office in person.

Because I am engaged in cargo transportation, then I work without officially registered employees, and most often alone. Here in the system you can do business this way without additional costs for unnecessary functionality.

The interface is clear, I figured it out on the first day. I hardly changed all the documents that I filled out (only my details). The calendar does not fail, I have set up all the reports, and receive timely notifications that I need to prepare papers. I also calmly set up a connection with the bank; I did almost nothing myself. As a result, what I have: I pay about 10 thousand a year for the service, I save a lot of time and nerves, without running through all sorts of authorities. This suits me 100%. I would pay special person, who worked with papers - every month it would cost 5 thousand, no less.

Grade: 4

This is the best service for individual entrepreneurs. If we take business as a whole, it is not universal. For example, individual entrepreneurs will not be able to work here on the general taxation system (but you can almost count them on one hand), I haven’t found how to make reports on the number of employees, how to take into account the characteristics of Chernobyl victims (also special cases) when taking maternity leave and vacations, etc. .d. In short, if you find fault, you can find many shortcomings. But for the simplest general business cases, especially for individual entrepreneurs, when you work alone, this is real the best option. It costs a penny (10 thousand rubles per year), allows you to report to the authorities, make all the reports, there are thousands of document forms in the system, competent consultants who will tell you not only how to work in the system, but also how to make this or that document. You can set up notifications, even via SMS, so you don’t forget about burning reports. I didn’t notice any disruptions in the work, the service is always available.

Grade: 5

I use “My Business” in my own individual entrepreneur. The service is very convenient, I like that all work with documents is online without desktop applications. Those. I have access to reports and finances from any device, just log in to my account. This is a huge advantage over the “boxed” versions.

Separately, it is worth mentioning integration with banks. I work with Alpha, there are no problems. I received the current account information from the bank and sent the documents to the “My Business” partners. It is much more convenient to work with an integrated account; all bank statements are received automatically. The system crashes from time to time and has to be handled manually. HR records are also pleasing: all personnel documentation is seamlessly integrated into the enterprise’s accounting department. It was not particularly easy to master, it took 3 days, plus I actively communicated with support and on the forums.

Regarding the price: many criticize, but it seems to me that 1.6k per month for the functionality provided is worth it. I have an individual entrepreneur on the simplified tax system, 2 subordinate employees in the service sector. Without the service, I would have been faced with a bunch of hemorrhoids and outsourcing, most likely, but as it is, I do everything myself.

In terms of capabilities: I previously worked with FE, here it’s almost the same, but more functional, as it seemed to me. Although in Elba the interface is friendlier. There is a master in preparing reports and taxes. Everything is done automatically, all that remains is to enter the initial data. Manual routine is really reduced to a minimum. Plus, it’s easier to submit reports to the Pension Fund, Social Insurance Fund and Tax Service. Everything arrives, there are no delays or penalties later.

Grade: 5

“My Business” is very sensibly organized, all the functionality is at hand. It is based on a personal account, which is registered to a legal entity or individual entrepreneur (as in my case), i.e. there is a link to OGRN/ORGNIP. All incoming or outgoing finances are processed through the “Money” section. You can download the cash book or KUDiR. Receipts and write-offs are processed manually; which category to enter into is clear from the description. “Documents” stores all invoices, invoices, acts, invoices. Agreements are presented in a separate section; on the one hand, there is no direct link to the corresponding accounts and acts, but on the other hand, the built-in templates are a brilliant thing. In total, there are more than 3 thousand of them in the system, according to various documents. The point is this: all the necessary information is entered into a separate section with counterparties, which is then inserted into the right places in the agreement (for example, parties, details). This makes working with documents much easier.

I don’t use the “Employees” section, because... there is no one under control. As the activity progresses, analytics are generated (functionality from Sineco is used). In principle, everything that is shown there can be done independently in Excel, but here it is collected automatically. Overall, it’s a good product that’s quick to learn, clearly structured, and conducive to running a small business.

Grade: 5

For an individual entrepreneur without employees, “My Business” is simply irreplaceable. It costs a penny (about 800 rubles, since the tariff without checking counterparties is 2 times more expensive with this option), and it significantly saves time. For example, the service can generate initial documents - contracts, invoices, acts. There are many forms, automatic filling according to details. Drawing up documents is much faster than manually in Word. Directly for business, it is interesting to keep a ledger of income and expenses (a mandatory attribute for individual entrepreneurs). As an accounting department, there is accounting of funds in circulation, operational accounting of products sold, projected income, and the possibility of inventory. Definitely worth the money. At the same time, everything works in the cloud, does not slow down, and access can be obtained anywhere.

Grade: 4

I have been running a business with the service for a couple of years. Not to say that My Business solves all problems, but in some ways it helps significantly. You cannot count on the service 100%, as there are occasional problems with it. Among these disadvantages, I would like to note the system freezing, long updates. In addition, there is no tariff designer; I would be happy to give up some unused functions in order to save money. Although in general the price is reasonable, it is higher compared to competitors such as Bukhsoft or Kontur. There is no absolutely complete functionality here, for example, the system does not work with individual entrepreneurs on a common system with VAT (only a simplification, imputation). Now, of course, almost no one works like this, but functionality could be added.

Among the advantages - a good approach to accounting, many accounting functions, integration with banks (though not all), everything is intuitive and simple.

Grade: 5

There are 5 people in my online store with me. The tariff chosen by “Internet Accounting” was 1,624 rubles per month. For this money, a special bot does part of the work for me. Taxes are calculated automatically, and all reporting is also completed with a minimum of my time. It is sent on time, this is monitored by the service accountant. The contracts are drawn up by a lawyer from My business, I sign them with suppliers, without delving into the nuances of the law. The service has integration with several banks. I have an account with Alpha, I import payments and all receipts are made online. The service is worth the money.

Grade: 5

When I registered myself as an individual entrepreneur, I helped a lot this service. First, after registering, I looked at the interface for free. Then I downloaded all the necessary forms from them and, using the service’s step-by-step prompts, filled them out myself. I liked the service and decided to continue using it. I had to pay for a full year because they didn’t offer any other options. It came out to over 800 rubles per month. Convenient calendar - reminds you of deadlines for submitting reports and making payments. Reports are submitted without traveling to funds. So far everything is fine. I send reports from the program directly to recipients; there is no need to travel anywhere. This results in significant time savings. I liked that it was free test mode. This allows you to decide whether the program is suitable or not for a particular organization. I have an opportunity automatic filling contracts and forms, the details of the enterprise are entered. If an LLC or individual entrepreneur has not yet been registered, using the program you can prepare the entire set of documents for the tax office for free. I had questions at the beginning of cooperation. I wanted to know specifically how certain numbers are formed. What I really like is that the consultants always answer any questions. The payment system is inconvenient; you can only pay for a year. Payments cannot be made quarterly or semi-annually. I bought paid subscription for consultation. They respond quickly. But if the question is really complex, they either send a formal reply, or the answer comes in a few days. During this time, you can find a solution to your problem for free.

Despite all the shortcomings, the program helps save time and is cheaper than similar versions of competitors. A huge plus is the ability to access from any device from anywhere, the main thing is that there is an uninterrupted Internet connection.

Banks Today Live

Articles marked with this symbol always relevant. We are monitoring this

And answers to comments to this article are given by qualified lawyer and the author himself articles.

Online accounting is becoming increasingly popular. This is convenient and profitable - there is no need to hire a full-time accountant and pay him a salary. After all, it can easily be replaced by Internet services designed specifically for small companies. But how to choose the right online accounting and not make a mistake?

Online accounting is, in fact, the same program for working with databases and calculations that is installed on regular computers and company servers. But it is installed on the server of a remote company, which provides it and supports its operation.

Cloud services allow you to remotely manage all accounting-related matters. In addition, most of them are capable of complementing standard programs own services and consultations.

Advantages of online accounting

The main advantage of accounting in the cloud is its low cost. Providing your own server and maintaining it is quite an expensive business. Needs to be maintained system administrator, purchase licensed software and renew it on time, support work separate server. Cloud online accounting services will allow you to avoid these expenses.

Also, online maintenance will allow you to fill out and send some documents without unnecessary effort - just press a couple of buttons. And individual services can be integrated into other resources - for example, online banking - and simplify working with them.

Cloud accounting is accessible from anywhere in the world and immediately to many trusted users. Therefore, it will be possible to hire a remote accountant or give a full-time accountant the opportunity to sometimes work part-time from home.

Moreover, the cloud service is this is reliability. Because the servers of such resources are protected much better than the server of some company. This includes encryption, a secure data center, and proprietary methods of protection against viruses and Trojans. You don't have to worry about the database.

The best cloud online accounting: TOP 8 services

There are a lot of special services for remote accounting. We have selected the best of them and compiled comparison table. This will help you choose the simplest, most convenient and appropriate service for each business - from small individual entrepreneurs to serious LLCs.

"My business"

More suitable for individual entrepreneurs USNO And UTII. Does not work with non-profit organizations. “My Business” is one of the most popular cloud services for online accounting. Provides a trial period of 30 days.

Through this cloud accounting service you can conduct accounting, warehouse, management, and tax accounting. It is also easy to calculate wages through it.

Naturally, all these services are provided within a certain tariff. There are three in total:

- Internet accounting. Just an automated online service and several consultations with accounting experts. Price – 833 rubles per month.

- Personal accountant. The tariff includes an automated bot for preparing primary documents, a personnel officer, an accountant and a business assistant. Costs from 6600 rubles per month. If your turnover is more than 500 thousand per month, this tariff will not work.

- Back office. A full-fledged team to resolve any issues. An expanded version of the previous tariff - professionals will resolve personnel issues and calculate salaries. The team also includes a lawyer. Price – minimum 12,000 rubles per month.

One of the main advantages is low cost. Even a full-fledged back office costs quite adequately. At least it’s much cheaper than keeping specialists on staff. “My Business” is easy to understand. And the liability of online accounting is insured for 100 million rubles.

Read also:

Review credit card"Simply Card" of Eastern Bank

There are few disadvantages - you cannot conduct personnel records and double-entry accounting through “My Business”. In addition, the service does not conduct financial analysis.

"Kontour.Elba"

Works with individual entrepreneurs and LLCs on UTII and simplified tax system.

For new users, the online accounting service will provide a trial period of 30 days. After it expires, you will have to choose one of four tariffs and continue to work according to it. Description of tariffs:

- Null. It includes zero reporting to the Federal Tax Service (except for reports for employees). Preparation and sending via the Internet. You don't have to pay for it.

- Economy. Suitable for individual entrepreneurs only. Preparation of a report to the Federal Tax Service (except for employees) and calculation of taxes for individual entrepreneurs. If possible, reduce taxes under the simplified tax system “Income” or UTII (for insurance premiums). Price – 1900 rubles per quarter. Per year – 4900 rubles.

- Business. It includes the Economy package. The preparation of documents, calculation of expenses and income, and so on are added. Cost – 4,500 rubles per quarter or 12,000 rubles per year.

- Premium. The most functional and convenient. It includes all the previous ones. The ability to calculate salaries, taxes and contributions for employees is also added. The service will prepare and send a report to the Social Insurance Fund and the Pension Fund. The price includes professional consultations. This pleasure costs 6,000 rubles per quarter or 18,000 rubles per year.

A big advantage is the presence special applications for smartphones. This will allow you to monitor your accounting not only from a computer or laptop, but also using mobile phone. Nice gift from Elbe for aspiring individual entrepreneurs – free use Premium tariff for a year. To do this, the individual entrepreneur must be registered less than three months ago.

There are also disadvantages. It is impossible to navigate through the Elbe inventory control, prepare management reporting and conduct financial analysis.

Attention! It is possible to get access to Elba free of charge for one year. To do this, you need to open a current account with Alfa Bank, after which you will receive a promotional code that gives you a year of free service at the maximum rate.

"Sky"

According to the developers, the service was primarily created for small businesses. Works with individual entrepreneurs and small business managers. Taxation systems - any, except for UTII and patents. Does not require any knowledge.

The test period here is shorter and is only two weeks versus a month for previous cloud accounting services. "Sky" offers several opportunities for the entrepreneur.

The first is a regular subscription to the service. Allows you to independently maintain records and use all services. Includes preparation of primary documents, automatic calculation of wages, taxes and contributions. Allows you to generate current reports and close the month without problems. Cost (in rubles): 650 per month, 1800 per quarter and 6500 per year.

Next are comprehensive packages for entrepreneurs. They are meant as an addition to the main account. The packages provide such opportunities as information requests from the taxpayer (on debts, for reconciliation with the tax office or changing the tax system), issuing electronic signature and much more. The cost of packages differs depending on the type of organization and taxation system:

- For individual entrepreneurs on the simplified tax system (without employees) – 6800 rubles.

- For IMs on the simplified tax system (with employees) – 8000 rubles.

- For an LLC on the simplified tax system or OSNO - 8900 rubles.

Read also:

Russian banks with a high degree of reliability - bank reliability rating for 2018

Sky is best suited for Alfa-Bank users, since the cloud accounting service is integrated into the banking system. Thanks to this, the client can quickly import statements and send payments. Note that the Elba and My Business services also have integration with Alfa Bank. Integration allows the service to automatically receive information on your banking transactions, on the basis of which the tax will later be calculated.

Outsourcing "Button"

“Button” will become an almost full-fledged back office for accounting. She will take care of almost all the paperwork and

The team includes a lawyer, an accountant and a business assistant. They will be able to fully engage with the company and not only manage its papers, but also solve legal problems, give useful tips for further development and search for opportunities.

The range of services that “Button” provides to all users is as follows:

- Reducing taxes and receiving benefits for business.

- Closing the month, posting all documents and statements.

- A nice bonus is insurance against errors of the “Button” service. Size – 100 million rubles.

- A proprietary application that stores all the necessary information on accounting and other issues related to its work.

All these services are included in the service at any tariff. But each has its own characteristics and additional features. The service is offered in three tariffs with different set services:

- Mini (7000 rubles per month). Works only with simplified tax system. The functionality is compressed, but suitable for small companies and individual entrepreneurs. Includes only the preparation and submission of reports, preparation for inspections and management of two employees.

- Button (24,000 rubles per month). Works with all tax systems. Employees will maintain bank accounts, work with paper documents and counterparties (including foreign ones).

- Plus button (31,000 rubles per month). In addition to all functions, it allows you to pre-calculate tax and reduce it, make a presentation when working with contractors, and resolve controversial legal issues.

"Button" also works with Alfa Bank, Tochka and Tinkoff. If the client has accounts with one of these organizations, then the service will also be able to service the current account.

"Bukhsoft"

Almost the most profitable online accounting service. It is simple, clear and includes many features. The online cloud accounting service works with all tax systems. Through Bukhsoft you can deal not only with accounting matters, but also with:

- monitor trade and related documents;

- calculate payroll and manage employees;

- prepare and test reports;

- send reports online to the relevant authorities and work remotely with counterparties;

- form accounting policy companies on OSN or simplified tax system;

- plan tasks for yourself and performers;

- maintain an accountant's calendar;

- connect an online cash register.

The minimum cost of a service package on Bukhsoft is 1,838 rubles per year (Accounting and Salary and HR). Sending reports online costs from 2,938 rubles per year. Prices are almost imperceptible for any company capable of getting out of the red.

The standard test period is 30 days. After this, you will have to select a service package and pay for it.

Read also:

Tax secrecy: concept, features, changes in legislation

"1C Bookkeeping.Online"

A separate service that allows you to maintain accounting, tax and personnel records remotely. The site also offers express business audits and tax advice in all its aspects.

The cost is calculated quite flexibly. When calculating the price per month, the following are taken into account:

- selected tariff (comprehensive service, reporting, payment, consultation and personnel decisions);

- type of ownership;

- taxation system;

- how many operations need to be performed per month (from 1 to 150 or more).

The minimum cost will be 800 rubles per month. The maximum is more than 60 thousand rubles, but this is already for large companies with a large document flow and many operations.

A nice bonus is that you can register a new business through the service.

1C Accounting Cloud

It is, rather, a service designed for online use of 1C programs. All a full-time accountant needs is a browser and an Internet connection. There are no special tools or features. The main advantage of this approach is the availability of the database from anywhere.

Specifically, Scloud offers enough advantages for a monthly subscription price of 700 rubles:

- uploading an existing database to the site;

- professional consultations;

- only licensed software;

- the ability to work not only through a browser, but also a special client program;

- additional highly specialized software.

Such services will allow the accountant to greatly facilitate the daily routine and work with greater convenience. 14 trial days are provided for evaluation.

However, this does not negate the fact that there are no additional helping services, much less a back office, here.

1C accounting “Live!”

The second cloud online accounting service based on 1C programs. Like the previous one, it allows you to work remotely on absolutely any accounting operations using licensed software.

"Live!" offers clients:

- flexible system for customizing packages - from basic programs to industry (medicine, hotel business, construction, and so on);

- free transfer of database and program configurations to servers;

- 5 gigabytes disk space on the Cloud for database storage;

- own 1C server for greater reliability with a convenient configurator.

A trial period of 7 days will allow you to familiarize yourself with all the possibilities. You can use the software under an existing license. Or rent a new one.

Comparison of tariffs of the best cloud online accounting services

We have collected current data on leading accounting services and compiled a comparative table of their important features.

| Price (month), rub. | Price (quarter), rub. | Price (year), rub. | Number of different tariffs/packages | Online service | Pro team | Benefits of the service | |

|---|---|---|---|---|---|---|---|

"My business» "My business»

|

from 833 | – | – | 3 | + | + (in one of the tariffs) |

The simplest and most versatile |

"Kontour.Elba" "Kontour.Elba"

|

– | from 1900 | from 4900 | 4 | + | – | There is a free plan |

"Sky" "Sky"

|

from 650 | from 1800 | from 6500 | 3 | + | – | Cheapest per month |

| "Button" | from 7000 | – | – | 3 | – | + | Full-fledged accounting department with its own specialists |

| "Bukhsoft" | – | – | from 1838 | 9 | + | – | Cheapest per year |

1C Bookkeeping Online 1C Bookkeeping Online

|

from 800 | – | – | 5 | + | – | Flexible customization of cost and functions |

Cloud Cloud

|

from 700 | – | – | 2 (modules available) | – | – | 15% discount when purchasing an annual subscription |

"Live!" "Live!"

|

from 1250 | – | from 15000 | 8 (with multiple modules) | – | – | The most convenient 1C service with industry division |

Hello, dear readers of the blog site. A successful modern business requires constant control by the owner. Using various professional accounting programs implies the presence on the staff of the organization of a highly qualified employee (although it is possible) who knows all the intricacies of the work process.

But in this case, the business owner receives only a general overview analysis of business activities, and in some cases this is not enough to make an important decision.

Active use of Internet accounting “My Business”, the operating principle of which is based on the provision of services software financial side of your business using the Internet.

Clients of this online accounting have the opportunity not only to independently keep records of business transactions, but also:

- Fill out tax returns;

- Send reports to regulatory authorities;

- Receive professional advice from consultants;

- Use an integration system with the servicing bank.

And this is just at a glance. Want to know more? Then don't switch...

General overview of work in My Business

Historical reference

But in general

Online accounting "My Business" can rightfully be called a successful program. The goals and objectives of the state program to support Russian small businesses are reflected in the work of the service. Both novice entrepreneurs and experienced owners receive a reliable assistant in the form of the service, capable of relieving the owner of the company as much as possible.

Accounting, tax and personnel records at the enterprise are organized in accordance with Russian legislation. The services offered are fully consistent with the target policy of the service: maximum saving of time and Money small business owners.

Good luck to you! See you soon on the pages of the blog site

You can watch more videos by going to");">

You might be interested

Antiplagiat.ru - online service, where you can check texts for uniqueness and identify plagiarism in any work (university, magazine)  Online FTP client Net2ftp and Google Alerts - useful services for webmasters Canva - design without a designer

Online FTP client Net2ftp and Google Alerts - useful services for webmasters Canva - design without a designer

Today, more and more companies and individual entrepreneurs are switching from standard system accounting and outsourcing to online accounting. The answer to the question “why is this happening” is simple – it’s convenient and profitable. After all, companies that use online accounting no longer need a permanent in-house accountant or seek services from third parties. Online accounting services are so simple and easy to use that any employee can do all the necessary calculations, even if he does not have a special education for this. It is quite natural that such services are highly popular, because any entrepreneur wants to save money.

And since there is demand, there is also supply. Let's look at an example of one of online accounting service “My Business” all the features and advantages of this type of accounting.

Let’s first take a quick look at how to start using the “My Business” service.

In addition, there is an automatic exchange of documents with partner banks, which will take seconds and save hours of your time. All bank statements will be automatically posted to expenses and income, the whole process will be fully displayed in your personal account. The tax calendar controls deadlines and reminds you in advance about submitting reports and paying fees via SMS and email. Video lessons and webinars of the service will tell you about registration and starting activities, accounting and tax calculations, reporting and personnel records. And if you have any questions, service specialists will answer you, regardless of the complexity of the situation.

Internet accounting “My Business” is absolutely safe, the risk of losing data is zero, your information is stored on servers in Europe, during transmission it is encrypted with a code like in the largest banks and is updated every fifteen minutes, and financial damage is insured. All service services are included in the tariff without additional or hidden fees, including unlimited expert consultations. All this is stated in the contract. By the way, if you want to devote all your time to your business, the service offers to completely handle your accounting for you. By registering on the company's website, you receive a free trial period with access to all services of the service.

Let's look at who this service is intended for

Today, there are many organizations and companies that primarily differ in their organizational and legal forms and tax system. The main types of organizational and legal forms of an enterprise are individual entrepreneurs (IP), limited liability companies (LLC), non-profit organizations (NPOs) and municipal unitary enterprises (MUP).

Online accounting is suitable only for individual entrepreneurs and LLCs. This information must be taken into account when choosing how to conduct accounting for your organization. In addition to organizational and legal forms, companies also differ in taxation systems. There are two main types of business taxation systems - the general scheme (OSNO) and the simplified scheme (STS).

BASIC – general system taxation. On general scheme be sure to lead a classic Accounting. Of all the above, this is the most unfavorable regime for the company, but for large organizations other taxation systems are often simply impossible.

simplified tax system– simplified taxation system. This special mode aimed at reducing the tax burden on small and medium business, as well as to facilitate and simplify tax and accounting. You can switch to the simplified tax system immediately upon registering your business. Almost all individual entrepreneurs operate under a simplified taxation system. There are subsections of the simplified taxation system: simplified tax system 6%, simplified tax system 15%, UTII, unified agricultural tax.

STS 6% is also called “STS income”. With this taxation system, 6% tax is paid on all amounts earned during the period. For example, a company sells cement. During the second quarter, the company purchased goods in bulk for 100 thousand rubles and sold them at a very high markup for 300 thousand rubles. The tax in the case of “income” will be 300 thousand * 6% = 18 thousand rubles.

The simplified tax system of 15% is also called “income minus expenses”. For most regions this tax is 15% (for some - 5, 10%). Under this taxation system, tax is paid on the difference between income and expenses for the period. Let's consider the same situation: a company sells cement. During the second quarter, the company purchased goods in bulk for 100 thousand rubles, and sold them for 300 thousand rubles. The tax in the case of “expenses” will be (300 thousand – 100 thousand) * 15% = 30 thousand rubles.

UTII- a single tax on imputed income. This tax replaces the usual ones. Only an organization that is engaged in certain activities (motor transport services, retail trade, catering services, etc.) can switch to this taxation system. UTII is regulated by municipal laws, the tax rate and types of activities may vary in different areas. Some organizations combine simplified taxation system and UTII.

Unified agricultural tax– single agricultural tax. This tax applies to agricultural producers and fish farms.

Internet accounting “My Business” is intended only for companies (individual entrepreneurs or LLCs) operating under the simplified tax system 6%, simplified tax system 15% and/or UTII. This service is not suitable for organizations that pay taxes under OSNO or Unified Agricultural Tax.

Features and advantages of the “My Business” service

First, you must register on the company’s website, select the appropriate tariff (there are several, depending on whether the organization has employees and how many) and pay for monthly services. After this, you will have access to your personal account, in which you can work at any convenient time and place where there is Internet access. In your personal account, you indicate the details of your company, and a personal tax calendar is generated for you. As you can see, everything is quite simple!

Let's take a closer look at the “My Business” personal account.

The first page of your account displays general information. You will see such tabs as “Home”, “Money”, “Documents”, “Inventory”, “Contracts”, “Cash”, “Counterparties”, “Salary”, “Employees”, “Forms”, “Analytics”, "Webinars".

In addition, the following services will be on the first page:

- Balance on the main current account.

- Selected documents.

- Expert consultations.

- Company business card.

- Contacts with technical support, instructions for using the service, ID, creating a one-time password.

- Information about the owner of the personal account, details of the organization.

More about tabs:

Tab "Home" contains the following services:

- Activity– tabs for creating counterparties and primary documents (these pages are also located in the “Counterparties” tab).

- Tax calendar– creation of reports, payment slips for payment of taxes and contributions. The reports made can be sent to government agencies using the Internet service, Russian Post, or submitted during a personal visit.

- Analytics– the “Analytics” tab is duplicated.

- Electronic reporting– statistics on reports sent via the Internet, correspondence with government agencies and reconciliation with the Federal Tax Service.

In tab "Money" collected tools for accounting for the organization’s cash transactions:

- Cash book layout and KUDIR. They can be downloaded and printed. The cash book is used to record receipts and cash disbursements at the organization's cash desk. KUDIR is a book for recording income and expenses; all individual entrepreneurs and organizations using a simplified taxation system are required to maintain it. It displays all business transactions for the reporting period in chronological order.

- Information on income and expenses. It can be entered manually or using a bank statement. When integration with Intesa Bank is configured, information on income and expenses from the current account is automatically sent to the service.

- Sending payment orders. With integration configured with Intesa Bank, payment orders can be sent to the online bank, where the payment is then confirmed and the money is transferred.

Internet accounting “My Business” is integrated with the services of some banks. Electronic document flow is organized between them. Thanks to this, it is possible to automatically exchange statements and payment orders between the “My Business” service and your current account, if, of course, it is opened in the appropriate bank. And all data from the statements is automatically reflected in accounting and tax accounting. Integration is available with the following banks: Alfa Bank, Intesa, MDM, SDM, Lokobank, Sberbank, Modulbank, Otkritie, Promsvyazbank. In addition to banks, integration is available with some other companies: Yandex. Money, Pony Express, Robokassa, Sape.

In tab "Documentation" You can create invoices, acts, invoices and invoices. In addition, this tab has a button for creating documents. To issue an invoice, you need to select it from the list. After this, the header opens and a convenient method is selected:

- download, print and transmit;

- send to email client;

- provide a link to payment by bank card or via Yandex. Money.

In the "Inventory" tab It is possible to issue an invoice for payment, ship or receive goods and materials, and transfer them from one warehouse to another. You will see all the information on the arrival, departure and balance of goods on this moment. For each movement in the warehouse, an invoice is created. It is also possible to select a warehouse or create a new one.

In the "Contracts" tab you can create a new agreement, download an agreement template and view statistics on previously created agreements. When creating a new agreement, you must select a client and an agreement template from the pop-up list for auto-filling. You will have access to nineteen standard contract templates created by My Business experts. If you have your own template, then you can upload it to the service and work on it.

Cashier tab works as a draft. All information comes from the “Money” tab. Here you can create draft PKOs (receipt cash orders) and RKOs (settlement cash orders).

Tab "Counterparties". In this tab, you can create a client, partner or counterparty, check your counterparty using a reconciliation report or an extract from the state register, and also view statistics on counterparties.

Counterparties are clients or partners with whom your company enters into contracts. Naturally, special tools have been created to work with them.

In the "Salary" tab information on payments to company employees is displayed:

- Calculations for all employees.

- Calculations for each employee.

- Documents for employees: payslip, pay sheets, statement of taxes and contributions, time sheet.

- Payments to employees.

Employees Tab will allow you to make calculations for vacation or sick leave. To do this, you need to select the employee's absence dates. You will see open calculation formulas and the total amount to be paid.

Forms tab will make your life easier by not having to search for information on the Internet and try to understand how relevant or outdated it is. You will have verified data at your disposal in the “Forms” section (more than 2000 forms of various documents, regulatory documents - laws, regulations, etc.).

Analytics tab will allow you to view statistics of income, expenses and profits for various periods of activity by month. For example, you can download payment statistics and compare data for different periods.

In the "Webinars" tab you will find video materials on changes in legislation, video instructions on working in your personal account, interviews with successful businessmen and experts.

So, we got acquainted with the main tabs of the “My Business” service. But not all of them are available to every client; it will depend on the tariff you choose. Let's take stock.

Internet accounting will allow you to automatically calculate salaries, accrue sick leave and vacation pay, keep accounting records, and send reports via the Internet.

In your personal account of the “My Business” service, you can create an invoice, agreement, act, invoice, etc. in just a few clicks.

The smart service itself will remind you of the deadlines, calculate taxes and send reports. In addition, the system will check the counterparty and also check with the tax office.

If necessary, you can always ask questions about reporting, documents, etc. to support service specialists. Consultants will answer these questions within 24 hours. The number of requests is unlimited.

It is possible to automatically exchange statements and payment orders between the service and your current account.

There are several tariffs, varying in cost and services, among which you can choose the most profitable for yourself.

Through mobile app for iPhone “My Business” you can use online accounting at any time and from anywhere.