Internet accounting "My business": reviews. Online accounting for small and medium businesses

Read also

Small, medium and even sometimes large enterprises need help organizing accounting and obtaining services related to this process: audit, expert advice, verification of counterparties, etc.

Let's look at the My Business service, which offers its users a comprehensive approach to bookkeeping and provides other Additional services.

What it is

Internet accounting "My business" (LINK) has been operating since 2009. During the first year, several thousand free and more than 1000 paid users registered in it. Year after year, the service expanded and supplied its users with more and more new services.

It works on the principle of SaaS, which means that users use the services via the Internet. It works in two versions: for professional accountants and for the most ordinary users who often do not understand anything in accounting.

Video - an overview of the online service of Internet accounting "My business":

So, the first version of the service (“My business. BUREAU”) provides users with the opportunity to solve any accounting and not only task.

Internet banking systems of many large Russian banks (Promsvyazbank, Alfa-Bank, Tinkoff Bank, more recently Sberbank and others) have been introduced into the service.

What services does Internet accounting "My business" provide?

Let's look at the services provided by the service in more detail.

Assistance with registration of LLC and IP

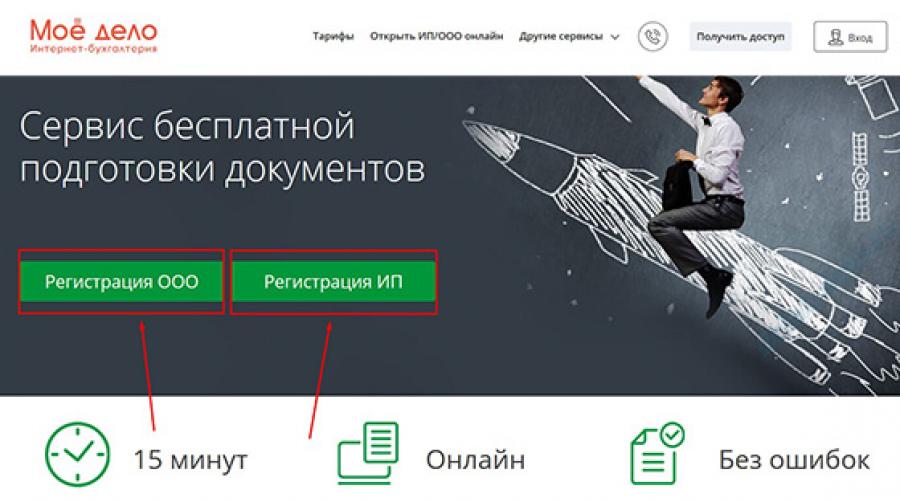

If you are registering as an individual entrepreneur for the first time or opening a company, then you can easily get confused with the algorithm of actions and with filling out documents. Internet accounting "My business" offers free help when registering an individual entrepreneur or LLC.

How it works? Everything is extremely simple:

- Go to the page of the My Business service for free preparation of documents for registering an individual entrepreneur or LLC - LINK. And choose the package of documents you need (LLC or IP).

- Register in the service by filling in several fields of the form:

- Gradually fill in all the necessary fields so that the program generates documents. Do not worry, hints await you at all stages of filling.

- You print documents. After you enter all the data, the service will automatically prepare all documents in accordance with the latest requirements of the legislation of the Russian Federation. A barcode is superimposed on the documents, and at the end of processing the document is checked according to the FTS reference book.

- In addition to the fact that the My Business service will prepare all the necessary documents for you for free, you will receive step by step guide for further actions, including also the address of the tax office closest to you.

bookkeeping

Now there are many offers from various outsourcing companies serving entrepreneurs, however, not everyone can afford them. "My business" is a service that offers services to individual entrepreneurs and LLCs at an affordable cost. Accounting with the help of My Business does not require special education or skills - in most cases, it is enough just to fill in the required fields according to the prompts.

Video - how to invoice a client:

The service is updated online and therefore it always reflects all changes in legislation. With this service you will be able to:

- create invoices and transactions;

- keep registers;

- take into account income and expenses;

- calculate salary;

- calculate taxes and insurance premiums;

- generate reports;

- … etc.

By the way, reporting to the Federal Tax Service will also become easier, because. through the service you can send documents via the Internet. Moreover, the clients of the service always have the opportunity to consult with experts in the field of accounting and taxation.

If your company has entered into a significant document flow, then it may make sense to consider another offer from My Business - a full accounting service. Watch the video presentation of this service:

“My business. BUREAU: a service for checking counterparties

Checking counterparties will help confirm that you are working with reliable companies. Using the service for checking counterparties “My business. Bureau" you will be able to determine the status of the counterparty, as well as check the data on the registration of a company or individual entrepreneur and receive an extract from the Unified State Register of Legal Entities. Moreover, the service will help to find errors if they were made in the details of the company.

Checking and in order to get an extract from the Unified State Register of Legal Entities or check registration data, be sure to specify the TIN and KPP of the counterparty you are interested in.

The service also helps to identify how likely the tax inspectorate or Rospotrebnadzor can come to you.

Functional evaluation

Both individual entrepreneurs and LLCs can work in the Internet accounting "My business". In the first case, it does not matter at all whether the individual entrepreneur has employees or not. If, for example, an individual entrepreneur does not have employees, then he can use the very first tariff called “Without employees”, on which basic functions are available.

The service provides enough opportunities for a full-fledged personnel records: for example, in order to create detailed profiles of employees, keep track of who was hired and who managed to leave, and also take into account all workers who work remotely.

The tax accounting system is also well organized. With the help of My Business Internet accounting, you can remotely (via the Internet) and also calculate taxes, for example, personal income tax. The service is based on cloud technologies, which means your data will never be lost.

The functionality also includes such sections as warehouse accounting and cash accounting. Functions at a minimum, but they are all necessary. Payroll is another big section of the service. You can calculate all types of deductions for employees (salaries, advances, bonuses, travel allowances, etc.).

Internet accounting "My business" also provides samples of all the basic documents that may be required by entrepreneurs. So, you can use ready-made forms: contracts, invoices, invoices, acts, accounting statements, orders, and so on.

If we compare My Business with other services, then its functionality is approximately on the same level as the most popular programs for accounting and tax accounting. The undoubted advantage of the service is the availability of sample forms - no other service can offer such a variety.

Tariffs "My business"

For LLCs and individual entrepreneurs, 4 tariffs are available to choose from: “Without employees”, “Up to 5 employees”, “Maximum” and “Personal accountant”.

Let's dwell on each in more detail.

| "Without employees" | "Up to 5 employees" | "Maximum" | "Personal accountant" |

| You can keep taxes, generate reports, prepare invoices and primary documents, and keep inventory records. Full access for consultation with experts. The cost is 833 rubles. per month. | You can keep taxes, generate reports, prepare invoices and primary documents, and keep inventory records. Full access to expert advice. Accounting for employees (up to 5 people) is also available. The cost is 1624 rubles. per month. | You can keep taxes, generate reports, prepare invoices and primary documents, and keep inventory records. Full access to expert advice. Work with employees (up to 100 people). The cost is 2083 rubles. per month. | You can keep taxes, generate reports, prepare invoices and primary documents, and keep inventory records. Full access to expert advice. The number of employees to be registered is unlimited. Reconciliation and verification of counterparties is available, as well as special service optimization of tax accounting. The cost is 3,500 rubles. per month. |

As you can see, the rates mostly depend on how many employees your individual entrepreneur or LLC has. The most popular tariff for an LLC is "Maximum", and for an individual entrepreneur - "Without employees", since individual entrepreneurs are most often newcomers, they work alone and prefer to do their own accounting.

For those who are just starting their own business MY BUSINESS- would be a great help. My business is a well-known company that provides all accounting records online. It has been on the market since 2009 and is currently popular. Users note the low cost of services, as well as convenient and clear interface programs.

The site is very famous and does not require additional introduction. For convenient use of the site, there is Personal Area user. It is constantly being improved and modernized. By clicking on the link https://www.moedelo.org you need to press the button "INPUT" on the right in the corner. Then enter the personal data (login and password) that were issued when registering an account on the site.

Registration of a personal account My business

New users need to register. For this on start page required to press the "Get Access" button. Next, fill out a short questionnaire: enter information about the organization, taxation and choose the most suitable tariff.

To complete the registration, you need to fill in the remaining fields of the questionnaire: name, email address mail, mobile number and come up with complex password. Follow these simple steps to complete your registration.

The service is created for all companies. It does not matter if you have a large company or you have just created your own business.

Personal account menu:

- documentation

- cash

- reserves

- agreements

- forms

- analytics

- seminars

- reports

If this is your first time encountering the program, then it is best to study the webinars, which describe in detail how to use your personal account.

Password recovery from personal account My business

When entering your personal account, carefully check the correctness of the entered characters. Is the correct language selected, also pay attention to whether the Capslock key is pressed. If after all the checks and several checks you were unable to log in, you need to use the "password recovery" service.

Open the login page and click "Forgot your password?". The password recovery tool will open. You need to enter the e-mail specified during registration.

Tariffs for using the My business service

After registering on the site, there is no need to choose a tariff. For starters, you can study each in detail.

- Without employees. IN Current Package includes the calculation of taxes and contributions, the formation and sending of reports, the preparation of primary documents and the formation of invoices, expert advice and inventory control. It is ideal for individual entrepreneurs on a simplified basis. No employed workers. The cost is only 833 rubles. For just a novice businessman, all the functionality is on one site.

- Up to 5 employees. Everything is the same, only the number of employees is five or less. The price is 1624 rubles.

- Maximum. The tariff is designed for large individual entrepreneurs or LLCs. The number of employees of the company is up to 100 people. Price 2083

- Personal accountant. Buying this tariff, you will be provided with a personal accountant. Price from 3500 rubles.

Hotline My business

If you have any difficult situations when working on the site, as well as questions about working in your personal account, you can solve it by calling the technical support service. You can also order a callback on the site. Employees in a short time to solve any problem. My Business Support Phone

The My Business service helps entrepreneurs and organizations minimize bookkeeping and reporting efforts, save time and focus on growing their business.

The user registers in the system, enters his data, on the basis of which a personal tax calendar is formed. From this moment on home page Reminders about reports and payments will be displayed.

Details that are entered into the system during registration will be automatically pulled up when generating reports, payment and primary documents. The user is relieved of the need to enter details manually each time.

Formation and sending of reports

The process of preparing reports takes no more than a couple of minutes. Forms are filled out on the basis of information that was entered into the system during the reporting period and a bank statement.

The finished report can be saved, printed or immediately sent to the desired authority, if connected electronic signature, which is issued free of charge in the service. In your personal account, you can track the status of submitted reports, as well as see comments or questions from the tax office.

Calculation and payment of taxes

The service itself calculates the amounts due to be paid to the budget in accordance with the requirements of the law, and offers options for reducing the tax. The calculation is visible to the user on the screen.

After the calculation, in one click, a payment order is generated with the current CCC. Any tax can be paid immediately convenient way: by electronic money, by card or through the Internet bank directly in the service.

Users can check with the tax office online and ask questions.

Invoicing and processing of primary documents

Invoices, waybills and acts are formed with filled in details, seal and signature. The counterparty is sent a link to the account, through which he can make payment in any convenient way. It is possible to set up automatic billing with the desired frequency.

Accounting

In the version for organizations, the amounts are automatically collected on the accounting accounts, and the totals are reflected in the balance sheet.

Service users have access to the database normative documents, up-to-date forms and templates of contracts for all occasions, and also have the opportunity to receive expert advice around the clock.

Service integration with banks and not only

For the convenience of users, the My Business service provides integration with banks, payment systems, and other services. This simplifies the work of both accountants and entrepreneurs if they keep records on their own.

Integration with banks

Easily connects to your personal account. After that, it will be possible to download a statement for the required period from your Internet bank by pressing one button. All receipts for and write-offs, together with the amounts, counterparties and payment purposes, will be independently distributed in the service.

You can pay the calculated tax with the integration enabled in two clicks. You just need to upload the payment form generated in the service to the Internet bank. All that remains to be done is to confirm the payment. No additional details need to be filled in.

With some banks, you can set up an automated exchange electronic documents, statements and payment orders between the user's current account and the My Business service.

Among the partners of the service are such large banks as:

- Alfa Bank;

- Tinkoff-Bank;

- Dot;

- Opening;

- Raiffeisen Bank;

- Promsvyazbank;

- Uralsib;

- BINBANK;

- OTB Bank;

- VTB 24;

- LocoBank;

- ModulBank;

- Intesa Bank.

Read also: Electronic digital signature(EDS) - what is it, where to do it and how to get it in 2019

Integration with other services

The My Business service provides the ability to integrate with well-known services to free the user from routine work and save their time.

1. ROBOKASSA

Payments accepted on the site and in in social networks, are automatically displayed in accounting.

2. Evotor

The My Business service generates reports on the online checkout, as well as automatically imports waybills.

3.Lifepay

The combination of smart cash accounting and online accounting allows you not to waste time manually entering data on completed transactions.

4.b2bfamily

Issuing invoices and primary documents created in the My Business service and tracking payment.

This is not a complete list of tools with which you can set up integration. The list of service partners is constantly expanding. My Business provides an external API so that you can exchange data with any service that is used in your work.

Using accessibility features of the service

In addition to accounting and reporting, users of the service are provided with many additional features, which facilitate and speed up the work:

The user formulates a question, attaches screenshots or documents if necessary, and sends it to the service experts. A detailed response from a specialist comes to your personal account within 24 hours.

The function is available to users who have connected electronic reporting by EDS, and for the FIU an agreement on electronic document management has been signed. The request will be delivered to the regulatory authority within one business day, and processed within 30 days in accordance with the regulations of the tax and FIU. The answer can be viewed in your personal account.

An extract can be obtained both for your organization and for counterparties in order to check their reliability. In most cases, the answer comes instantly. The number of requested extracts is not limited.

In the personal account, users have access to training videos and webinars, from which you can get useful information on accounting, taxation, changes in legislation, as well as on the possibilities of the service.

Allows you to continue working anywhere and not depend on the computer. You can issue invoices and closing documents, monitor the status of settlements, control receipts and debits from accounts, as well as consult with experts directly from your smartphone.

The cost of paying for the My Business service can be included in the costs. To do this, the system provides the ability to generate an act of work performed.

For users of the service there is a 24-hour technical support. You need to call the number 8 800 200 77 27 - and any problem will be fixed.

Personnel accounting

For organizations and entrepreneurs that have employees, the My Business service provides opportunities to keep personnel records, make payments to employees and generate reports that are mandatory for employers:

- Reception of employees.

Newly hired employees are easily and simply added to the system. It is enough to request documents from the employee, enter his data, and the service will automatically generate an employment contract, an application and an order for employment. They only need to be printed and signed.

Employees who work under a civil law contract are also entered into the system, but already outside the state - they are kept separately.

The service allows you to apply for employment and citizens of another state in compliance with the requirements of the law.

- Wage.

Reviews: 35

popular with users

Grade

website

Site score

The algorithms for calculating the rating of services take into account:

- user ratings;

- who wrote the review (for users, with a confirmed

"Expert" status, reviews have more "weight");

- how long ago the review was written (recent reviews have more

high priority);

- activity of commenting by the service representative

posted reviews.

Moe Delo online accounting popular with users

Reviews: 35

"My Business" is an automated online service that allows you to keep accounting records without special education. The service is perfect for inexperienced entrepreneurs and small companies, it allows you to automate accounting and save yourself from more than 80% of manual operations. The user enters all the necessary data into the system, monitors the calendar and communicates with the inspection authorities. The service, in turn, can automatically download and recognize bank statements for income / expenses, remind you of reports, calculate taxes and wages of employees, and generate all the required documents.

System functionality:

- tax calendar - demonstration of past and current tax events, notifications;

- invoicing - services with a payment button can instantly issue an invoice, and users can pay it in several ways;

- online reports - the system prepares and submits all reports to the FIU, the FSS and the tax service via the Internet;

- tax reconciliation - information about debts and communication with inspectors;

- data exchange with the bank – payment orders can be sent to the Internet bank, cash flow statements can be easily downloaded.

This site is blocked by Roskomnadzor for Russian ip-addresses.

Reviews

With the help of the My Business service, we were finally able to establish accounting in the company. I myself do not have an accounting education, I had to lead by trial and error, as if blindfolded on a tightrope over an abyss. Although the service had a lot of tips and instructions, there was neither time nor desire to read them. But now outsourcing is held in high esteem, so we decided to keep up with the trends. It is very convenient, there is no need to keep a large staff - you give a task and they solve it. What's great is that they take responsibility for doing the work and some possible mistakes, which, for example, is not always found in ordinary freelancers. But everyone meets the deadlines, there were never any jambs. The only thing is that during reporting periods it is sometimes difficult to get through to hotline it happens, but here you really need to understand that it's hot and everyone is calling. But the advantages in the form of unloading the head and the appearance of free hands are difficult to kill. So it's worth using, the service is quality.

My case offers a normal job option. If you do not want to worry about accounting, outsourcing is a topic. I transferred my company last year. I abolished the accounting department, if there are any questions, I solve it myself. And so everyone is led by specialists from My business. During this time, there were no problems with their work.

I might also think about whether to switch to outsourcing or not. But liability insurance for me is the first argument. I have already had to pay tax fines more than once because of the careless attitude to the work of my employees. But now everything is different - I am sure that everything is in order with me. Well, if there is a jamb, then there is someone to answer for it in the company My business. I have not come across yet, and I hope I will not have to, but everything is clearly spelled out in the contract.

I started with a small furniture store, and now I have 3 of them and own production. I don’t have enough time for bookkeeping, and I won’t pull it - my knowledge from zero cash is no longer enough. Previously, a friend dealt with all issues, but already an old one - she decided to retire, so she decided to transfer the company to outsourcing. I realized that I made the right choice when I chose My case. In reality, professional accountants work here, and even as a team, and not just one person. And the format of cooperation itself is convenient for me, only the sellers at the points send documents, and I practically don’t waste my time.

I have known my business for a long time, initially I really dealt with online accounting, then I realized that I can’t really cope with independent management, as the company is growing little by little. Decided to see what else they had and came across accounting outsourcing. It turned out - what you need. In principle, I give the same amount of money as the earlier incoming bukh (even a little less), and as a result I have a trained staff of specialists. I think now that accounting outsourcing was one of the best decisions.

In fact, I don’t quite understand where so much negativity towards My Case came from. In addition to the fact that they have some of the most favorable conditions on the market for small businesses, they also have a cool service, where I see everything that I do as an accountant at a level that is understandable to me. Seriously, at first I was rather skeptical, but in the end I now regret that I didn’t go into accounting outsourcing earlier. They work with high quality, the specialists are trained and in the right quantity without a shortage, in addition, they also bear responsibility, which also inspires confidence. Separately, I want to say about the new mobile app- insanely convenient to set tasks and track the status of each.

I see that the reviews are contradictory, I can not help but intervene. I've been using accounting outsourcing for about half a year now, and My Business has a credit for it. Everything has already been written here - the specialists, in fact, keep accounting for you, and they keep it competently and well, just pay on time. If you are a little paranoid, you can check their work through your personal account. I did this periodically at first, then less often. All the same, outsourcing ultimately turned out to be more convenient than doing business on your own.

As a person who first used online accounting, and then switched to accounting outsourcing, I can only praise Moe Delo. Initially, I thought that a remote accountant was an uncontrollable topic. But everything turned out to be great - several specialists do everything for a full-time accountant, you can check the work through your personal account, at the same time you can see that everything is transparent with them, if there is a delay, I will see it. In which case, the responsibility is on them, no throwing jambs (which, by the way, there are practically no delays for the last couple of months, I don’t remember, they work really well).

I have my own business and for a long time I did all the bookkeeping myself. I had to spend a lot of time and effort on filling out tedious reports for the tax and all sorts of papers. There was a period when I had to hire a full-time accountant. As a result, I did not pull financially. Colleagues recommended outsourcing, but I was afraid to trust important information and transactions with third party accounts. For a long time I chose the appropriate outsourcing, studied information on the websites of various companies, read user reviews. As a result, I decided to try the accounting outsourcing service My business. And I didn't guess. Professional team of accountants. Reporting is delivered on time and without jambs. Great service for everyone, IMHO.

I recommend to everyone to try "My business", especially to beginners and laymen in accounting. The service opened up a lot of opportunities for me to do my own bookkeeping. The program is very easy to use, everything is intuitive and accessible. For completely inexperienced users, there is technical support, online seminars and various hints. Now, with the help of "My Business", I generate all the reporting for the tax office on my own without extra troubles. So far I use the minimum tariff, which is valid for a year. In the future, I want to try outsourcing. This is full accounting support by remote specialists for little money.

My case is great for those who don't want to waste precious time doing bookkeeping on their own. This activity can now be safely outsourced, which I did some time ago. As a result, I received professional help in the form of remote specialists who deal with all reporting, payments, statements and other financial things instead of me. I was very pleased that you can follow all the actions. For this, a personal account is set up, which displays all operations with accounts. The system works without interruption, and the specialists always stay in touch. It is very convenient that all important issues can be discussed and resolved online through a special chat. The service helped me save on the salary of a full-time employee and free up funds.

I opened an individual entrepreneur, I immediately realized, even at the registration stage, that now they simply won’t let me live in peace with the papers, how long it takes to figure it all out ... And if there’s some kind of jamb, then the fines are right there. There is so much information on accounting on the Internet that it just boiled my head. At some point, I realized that it was necessary to transfer all this into the hands of specialists, but there was not enough money to hire an accountant. And the same internet gave me a solution. Accounting outsourcing. In My business, I liked that you can ask any business answer you are interested in at any time and get a well-reasoned, clear answer to it. And this is all in addition to the basic accounting. By the way, they also keep reporting very quickly, there is integration with my bank, so they transfer all the documentation there without me to each other. So, bringing this whole process to a remote location turned out to be a very right decision.

My company is engaged in design and construction work, due to the specifics of the activity, the financial statements are different big amount nuances. Tax legislation is constantly changing, and it is not always possible to correctly draw up documentation. One day he asked for help in "My business". Accountants worked through all the papers thoroughly, so that the tax did not get to the bottom. Now I am their regular customer.

Most of the work in My business is automated. I spend 4 hours a week checking payments, looking at the tax calendar to see who has to file, all reporting is generated in a few clicks and submitted online. The salary is considered and also everything is automatic. Integrated with the bank, integrated with the online cash register, integrated with CRM.

Really functional and comfortable.

From the very beginning of the opening, LLCs left an application for registration in My business, they removed all questions on the preparation of documents, the selection of a taxation system, after which we began to use their service at a discount and without hiccups.

I want to leave a review about the My Business program, which had high hopes, but alas! The program is crude and not adapted to bookkeeping, let alone a warehouse. For a year we have suffered so much that it is beyond words. If you have services or a small Company with goods from 100 items, it will suit you, in other cases you will suffer for a long time. We have 30 thousand stationery and items. And here are some of the difficulties that you will face:

1) the nomenclature is recognized not by the article but by the name. We upload the receipt or data for the account or the retail shift from excel and the service produces and uploads every time creating new products! As a result, up to 5 duplicates are obtained for one product, because of this it doesn’t converge at all, there’s nothing to carry the leftovers where necessary.

2) If you want to invoice a counterparty for 100 positions and want to make a 5% discount, for example, you will have to register this in each position for all 100 positions. There is no way to simply discount the entire invoice.

3) There are no acts of write-off or re-grading of goods. They offer a very strange method for you to go to the arrival of the goods that you want to write off and transfer it to materials, not thinking that before that, for 5 years, everything was out of service and there is no way to do this.

4) Report on retail the balances of goods are not reflected during the transaction, it is proposed to find out about this either at the end of the month or year, or to look for it in the movement of goods. Well, so that later it would not be boring for you to close the year, because you won’t get along with anything that the goods for twins are built up. But you'll only find out when you close.

5) Counterparties are also duplicated and are not searched for by TIN only by name. You create an account, start a new counterparty, after paying from the statement, another one is created and so many times, and as you understand, you have to manually delete and rebalance it all.

6) If you have Evotor, do not write off to enjoy the integration, all sales are recorded, but there are no returns. You must manually enter them every day and you will find out about it right before closing and paying for the simplified tax system. And you also manually calculate the commission for Acquiring.

7) If you do not have an Evotor, but for example Atol or other equipment in retail, get ready for the fact that you will enter the proceeds manually, but you will be facilitated by entering through excel)))

8) There are also constant problems with statements, rarely when it is correct. It would be better if it were not loaded automatically, but by hand it would be easier.

9) The support service often does not understand and does not know its service at all and offers some strange solutions.

10) The function of salary and personnel is underdeveloped

In fact, keeping records becomes very complicated and it becomes obvious that with such success it is possible to keep records in a notebook on your knee and with accounts.

It is a pity so much lost time and the nerve will leave. We led LLC USN 6% + Employees and individual entrepreneurs to USN 6% without employees.

I have been using the accounting system My business and the accounting system My business for more than a year. Everything that we need for trading is either in the service or integrated into it: Evotor online cash desk, online bank. More important point I would like to note that they advise in the chat on any issues - legal, accounting and even tax, a couple of times it helped a lot. The interface is intuitive and simple, I think everyone can figure out all the features of the system, it took me a couple of days, a couple more to train employees.

At first, we used the service at a rate of up to 5 employees, over the course of a year we grew up and switched from Internet accounting My business to their accounting outsourcing. There is more time for managing sales and new projects, all accounting, including personnel management, legal issues, and interaction with the tax authorities, was outsourced. My business. They periodically send recommendations and remind us if we have not sent them any closing documents from clients. We continue to use the service itself, we see everything that happens with money, there is a chat with consultants and it is convenient to issue invoices.

I opened my IP six months ago, I planned that I would do all the accounting on my own, but I was constantly torn between all sorts of bureaucratic tasks and the desire to devote all my time to business development. IN certain moment I finally realized that time is not rubber, and I'm not a superman, so I chose the Internet accounting My business. Cheap, cheerful and saves me a lot of time))) Good service, which I can safely recommend to those who want to keep abreast of their business, thanks to My Business.

I myself live in small town, and we have a problem finding a good accountant - I would be glad to pay a salary to a specialist, but I don’t want to just give money for something that I can do myself. Yes, and then tremble during tax audits and wait for fines. Therefore, the My business service became a real find for me - I tested it for three days at first, then they gave me another two weeks free use, and I realized - this is what I need. I outsourced my bookkeeping to a company, and now I know that my company is handled by professionals. If you have any questions, I can always contact the consultants - the answer is guaranteed within 24 hours.

I have been using the service "My business" for four months - this time was enough to form an opinion about the company. The opinion, by the way, formed a good one. With them, I save a lot of my time - most of the work in the field of accounting is now automated - accounts, primary documentation, taxes, reporting, and more. A couple of times I turned to the company's managers for advice - they gave exhaustive answers to my questions with references to the laws and articles of the legislation of the Russian Federation. So there is some time left for yourself.

The service is good for small businesses. I've been using it for 5 years and it has never let me down. When I started, I calmly figured out everything, now I do everything automatically. The tariff is the cheapest, there is no one in the state, no one needs to apply for sick leave / vacation. Clearly draw up income / expenses, calculate taxes, write out various documents, remake contract templates for yourself, etc. All in user-friendly interface. For the entire period of use, no checks have ever dug in, all taxes are paid on time, the authorities have no complaints. The price may not be the cheapest, especially now that dozens of analogues have appeared, but I do not change for 2 reasons:

1) here I completely trust, the quality is time-tested; 2) on test periods it is clear that the functionality I need for analogues will be more expensive than here, and I see no reason to overpay

Without the skills of an accountant (or at least an idea of how everything works), using the service is not as easy as it might seem. Plus, there are errors in it: in particular, according to the universal transfer document for sale, it does not minus VAT from the buyer's advance. This leads to incorrect filing of the VAT return, and as a result, excessive tax payments to the budget. How support responds to such problems in the system: they offer to create an invoice receipt (act), and not a universal transfer document. Despite the fact that I do not accept (that is, it is not an admission that is issued), but I implement it. In other words, the so-called experts do not really understand the topic. Otherwise, if we touch on the most common operations, everything is in order. At least it works stably and you don’t have to constantly update the data, wait until everything fades. And yes, 1C is much easier. Let that program in aggregate be, it seems to me, more functional, for ordinary entrepreneurs, online accounting from Moe Delo is better. At least if there is no desire to spend money on an accountant.

The main advantage of online accounting is that you do not need to hire a real accountant in the company or outsource it. The service is much more economical. It takes less than 20 thousand a year, this is the average salary of an accountant per month in the region. But you have to figure everything out on your own. Mastering bookkeeping from cover to cover, of course, is not required. But you need to know the basics. In principle, this way you understand your business even better.

The cost of the service can be customized. The difference in tariffs mainly depends on the size of the company where the service is being implemented. The cheapest individual entrepreneur without employees, I have a tariff of up to 5 employees (can be used by legal entities). You need to buy immediately for a year, there is no monthly fee. The functionality is rich. First, it calculates all taxes and contributions for employees. They are also considered as personnel and I calculate their salaries. Secondly, it helps with reports and their sending. I have an ES, which means I send reports in electronic form directly from the personal account.

Thirdly, all work with documents is in the interface. Indeed, all I needed at least once: invoices, closing documents, various contracts (there are a lot of templates in the database) and much more. And the service is synchronized with the bank. There is almost nothing to criticize the service for. Subjectively, I can scold only the interface. But then someone like it, personally I find it uncomfortable. If you could customize your account, remove unnecessary blocks, add widgets, etc., it would be much more convenient. It's just a bunch of tabs. But over time you get used to it, I already don’t notice it.

Well, support. She works around the clock, more than once addressed even the most stupid questions, they always answer. But it happens that if there is a hot period (end of the year, quarter), when everyone submits reports, then the support girls are tired and weakly make contact, do not try to delve into the problem. As a person, I understand them, but as a specialist, they must also work. And for some, competence is questionable.

I conduct IP through My Business. In principle, the business started with this service, and did not switch to it with a finished case. To open an IP was able to prepare all the necessary documents. Everything is written in detail, what is needed, what to fill out, etc. There is no need to search on the Internet or run to the tax office in person.

Because I am engaged in cargo transportation, then I work without officially registered employees, and most often alone. Here in the system it is just possible to conduct business in this way without additional costs for unnecessary functionality.

The interface is clear, figured it out on the first day. I almost did not change all the documents that I filled out (only my details). The calendar does not fail, I set up all the reports, I receive timely notifications that papers need to be prepared. I also calmly set up a connection with the bank, I did almost nothing myself. As a result, what I have: I pay about 10 thousand a year for the service, I save a lot of time and nerves without running to all sorts of authorities. It suits me 100%. I would pay a special person who worked with papers - every month it would take 5 thousand, no less.

For individual entrepreneurs, this is the best service. If we take the business as a whole, then it is not universal. For example, IP common system taxation will not be able to work here (but you can almost count them on the fingers), I did not find how to make reports on the s / s number, how to take into account the characteristics of Chernobyl victims (also special cases) during decrees and holidays, etc. In short, if you find fault, then you can find a lot of shortcomings. But for the simplest general business cases, especially for individual entrepreneurs, when you work alone, this is real the best option. It costs a penny (a year - 10 tr.), allows you to report to the authorities, make all reports, there are thousands of document forms in the system, competent consultants who will tell you not only how to work in the system, but also how to make this or that document. You can set up notifications, even via SMS, so as not to forget about burning reports. I did not notice any violations in the work, the service is always available.

I use "My business" in my own IP. The service is very convenient, I like that all work with documents is online without desktop applications. Those. I have access to reports, finances from any device, just log into my account. This is a huge advantage over the "box" versions.

Separately, it is worth mentioning the integration with banks. I work with Alpha, there are no problems. At the bank, I received data on the current account, sent the docks to the partners of My Business. It is much more convenient to work with an integrated account, all bank statements come automatically. The system crashes from time to time, you have to handle it manually. Personnel accounting is also pleasing: in the accounting department of the enterprise, all personnel documentation is easily integrated. It was not very easy to master, everything took 3 days, plus I actively communicated with support and on the forums.

Regarding the price: many people criticize, but it seems to me that 1.6k per month for the functionality provided is worth it. I have an individual entrepreneur on the simplified tax system, 2 subordinate employees in the service sector. Without the service, a bunch of hemorrhoids and outsourcing, most likely, would have been waiting for me, but otherwise I do everything myself.

According to the possibilities: I previously worked with CE, here it is almost the same, but more functional, as it seemed to me. Although the interface is friendlier in Elba. There is a master for preparing reports, for taxes. Everything is done automatically, it remains only to drive in the initial data. Manual routine is really reduced to a minimum. Plus, it’s easier to submit reports to the FIU, FSS and tax. Everything comes, there are no delays and penalties later.

“My business” is very intelligently arranged, all the functionality is at hand. It is based on a personal account, which is issued to a legal entity or individual entrepreneur (as in my case), i.e. there is a binding to OGRN/ORGNIP. All incoming or outgoing finances are processed through the "Money" section. You can download the cash book or KUDiR. Receipts and write-offs are processed manually, in which category to enter - it is clear from the description. All invoices, invoices, acts, invoices are stored in the "Documents". Contracts are presented in a separate section, on the one hand, there is no direct link to the relevant accounts and acts, but on the other hand, built-in templates are a brilliant thing. There are more than 3 thousand of them in the system as a whole according to various documents. The bottom line is that all the necessary information is entered in a separate section with counterparties, which is then inserted into the right places in the contract (for example, parties, details). This makes it much easier to work with documents.

I don’t use the “Employees” section, because no one is under control. In the course of activity, analytics is formed (functionality from Sineko is used). In principle, everything that is shown there can be done independently in Excel, but here it is collected automatically. All in all, a good product that is quick to learn, well built, and conducive to small business.

Internet bookkeeping My business is online service to control and record various kinds of documentation. This is a reliable and popular resource where real professionals work. The main advantage of the project is that absolutely everyone can work with it, having the opportunity to try out the functionality for free.

Functionality of My Business Service

The main functional features of the site can be summarized in the following list:

- The development team has prepared a unique product, which has no analogues on this moment No

- A special service was developed to work with LLCs and individual entrepreneurs

- Project liability is insured for 100,000 rubles

- Any data is encrypted according to exactly the same scheme as in leading domestic banks

- API for exchanging data with any service that you use

- Integration is set up with the largest banks in the country

- A unique service for checking counterparties has been developed

Online accounting My business has a huge number of differences from competitors, which is why the project has earned popularity so quickly. The above features are far from the only ones.

Tariff plans - My Business

Accounting service My business can be tried completely free of charge, but the functionality will be somewhat curtailed. To use the program in full, you need to pay for one of the types of access:

- "Internet accounting" will cost you 833 rubles per month of use. At the moment, the tariff is the most economical in the system

- "Personal accountant" includes not only a completely open service, but also a team of assistants and a bot that can perform routine work on its own. Such a complex costs 6600 rubles per month

- "Back office" is the most full program. This option optimized to work with serious businessmen or entire enterprises. Your team will consist of a lawyer, accountant, human resources officer and business assistant, which will allow you to work in a more multitasking mode. The cost of the product is 12.000 rubles per month

Tariffs My business Internet accounting can be studied in more detail on the project website. For all questions, you can contact the current support service.

As you can see, the developers tried to adapt the project to any needs, which will significantly save money, or put everything in order in the process of developing an entrepreneurial business. This service is useful not only for experienced businessmen, but also for beginners who are just starting their journey in hard work.

How to register on the My Business service?

The registration process is extremely simple. The program My business accounting will become available after you create your personal account. The registration procedure consists of several steps:

- Determine the type of your responsibility (it can be an individual entrepreneur or LLC)

- Specify the system of taxation

- Specify the desired version for working with the service

Also, a document will be offered for review, in which the user will get acquainted with all the provisions of further cooperation. Each field in the registration form is mandatory.

Personal team

When you pay for the full package, a whole team of specialists will begin to cooperate with you, including a personal accountant, business assistant, tax officer, lawyer and personnel officer. Your case will be handed over to professionals who specialize in your industry. Multitasking is the main emphasis on which the work of the service was oriented, so each task will be performed at the highest level.

You can choose a team yourself. To learn more about the list of all actions assigned to the team, you can open a special block on the official website of the resource.

Distinctive features of My Business

Let's take a closer look at the list of the most prominent features of this site:

- My business is a service for checking counterparties. Thanks to this feature, you can quickly get all the data about your counterparty. For example, the site contains the permitted data of the most popular Russian companies such as Aeroflot and Russian Railways

- My business is an online bookkeeping service. This component was given special attention. Each client will be impressed by the automatic operation of the bot named "Andryusha", which copes with the same type of tasks with computer accuracy, and greatly contributes to the acceleration of the workflow

- My business is outsourcing. You only need to set a well-defined task to a personal assistant. In order to facilitate the process, you send photos of documents, after which all work begins. Even novice businessmen will not be able to make mistakes with paperwork, since the work is carried out by a specially configured bot

- My business is an online checkout. especially useful given function becomes for retail stores. With the help of cash desks, you can easily control purchases, take inventory, save information about suppliers, work with groups of goods, and so on. The function itself works at 2 different tariffs, information about which can be studied in more detail on the official website

The main advantages and disadvantages of My Business

- Saving you time Incredible time savings, as the tasks will be solved accurately

- Instant support response Usually the wait is less than a minute.

- Convenient and clear functionality Incredible functionality that can solve absolutely every task that the client sets

- original software, unparalleled

- Bot A bot capable of automatically solving many similar tasks

- Simplicity Intuitive use of all functions

- Tariff cost The first thing that users note is the high cost of tariffs, as a result of which competitors in the field of online accounting can offer more favorable conditions.

- Test period A small test period, which is hardly enough to explore all the features of the product

draw conclusions on the topic this service is possible only after independent operation, since it is impossible to describe all the features and advantages within the framework of the article. It is one of the most functional and modern projects of a kind that is gaining more and more popularity in business circles every day.