My office is my business. "My business" - entrance to the "Personal account" of Internet accounting

Read also

Keeping records in the My Business service allows you not to spend a lot of time calculating taxes. The service itself calculates taxes and contributions payable, taking into account the most current changes in legislation.

The probability of errors is practically excluded, since the calculation is fully automated. Thanks to this, you can not be afraid of fines and penalties.

Everything is taken into account in the service possible ways reduce tax payments. When calculating the tax, you will be offered all possible options. You will see for yourself the maximum amount of tax deductions.

Tax calculation

- advance payments under the simplified tax system and tax for the year

- quarterly UTII payments

- patent payments

- sales tax amount

- income tax

- value added tax

Any payment is calculated in a special wizard. You will be able to see step by step how your tax is calculated.

Calculation of contributions

- IP fixed payments

- additional contribution from the entrepreneur

- contributions to the funds from the salaries of employees

Fixed IP contributions are calculated based on the date of registration. You do not have to overpay them for an incomplete year of work. When calculating contributions for employees, the service takes into account the possibility of regression - reducing contribution rates when the accrued salary reaches threshold values.

Additional features

In the service, you can at any time order a certificate of settlements with the budget, which allows you to control online the absence of tax debts. For reconciliation, you no longer need to visit the inspection.

The Tax Calendar will remind you in advance of the approaching deadlines for tax payments. In addition, you can set up notifications. Reminders will be sent to you by SMS or e-mail to the contacts you specified.

The wizard for calculating any tax or contribution provides for the possibility of generating a payment document. LLC can form a payment order.

For IP, there are more options. They can generate a payment for the bank or a receipt for paying the tax in cash. In addition, they can pay taxes bank card or electronic money directly from your personal account.

The payment order for tax payment can be uploaded directly to your Internet bank. Connected integration with leading banks allows you to do this. You will only have to confirm the payment, and the tax is paid.

Small, medium and even sometimes large enterprises need help organizing accounting and obtaining services related to this process: audit, expert advice, verification of counterparties, etc.

Let's look at the My Business service, which offers its users an integrated approach to bookkeeping and provides other additional services.

What it is

Internet accounting "My business" (LINK) has been operating since 2009. During the first year, several thousand free and more than 1000 paid users registered in it. Year after year, the service expanded and supplied its users with more and more new services.

It works on the principle of SaaS, which means that users use the services via the Internet. It works in two versions: for professional accountants and for the most ordinary users who often do not understand anything in accounting.

Video - an overview of the online service of Internet accounting "My business":

So, the first version of the service (“My business. BUREAU”) provides users with the opportunity to solve any accounting and not only task.

Internet banking systems of many large Russian banks (Promsvyazbank, Alfa-Bank, Tinkoff Bank, more recently Sberbank and others) have been introduced into the service.

What services does Internet accounting "My business" provide?

Let's look at the services provided by the service in more detail.

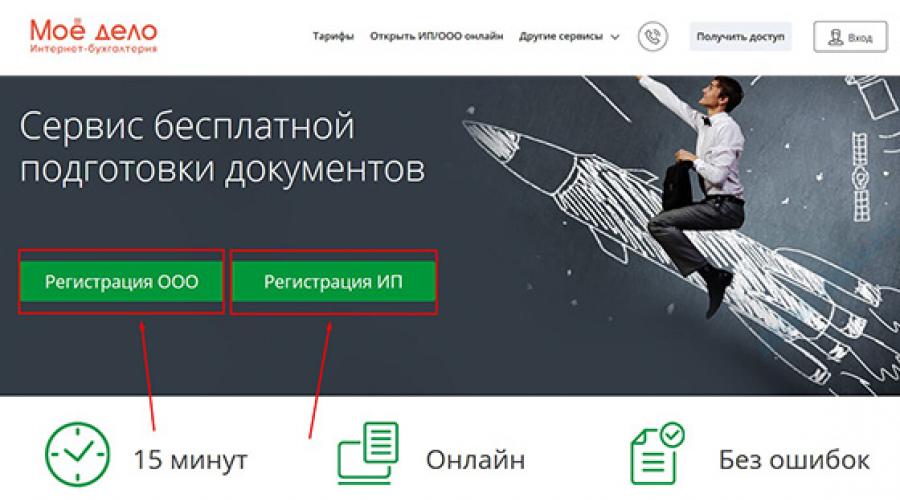

Assistance with registration of LLC and IP

If you are registering as an individual entrepreneur for the first time or opening a company, then you can easily get confused with the algorithm of actions and with filling out documents. Internet accounting "My business" offers free help when registering an individual entrepreneur or LLC.

How it works? Everything is extremely simple:

- Go to the page of the My Business service for free preparation of documents for registering an individual entrepreneur or LLC - LINK. And choose the package of documents you need (LLC or IP).

- Register in the service by filling in several fields of the form:

- Gradually fill in all the necessary fields so that the program generates documents. Do not worry, hints await you at all stages of filling.

- You print documents. After you enter all the data, the service will automatically prepare all documents in accordance with the latest requirements of the legislation of the Russian Federation. A barcode is superimposed on the documents, and at the end of processing the document is checked according to the FTS reference book.

- In addition to the fact that the My Business service will prepare all the necessary documents for you for free, you will receive step by step guide for further actions, including also the address of the tax office closest to you.

bookkeeping

Now there are many offers from various outsourcing companies serving entrepreneurs, however, not everyone can afford them. "My business" is a service that offers services to individual entrepreneurs and LLCs at an affordable cost. Accounting with the help of My Business does not require special education or skills - in most cases, it is enough just to fill in the required fields according to the prompts.

Video - how to invoice a client:

The service is updated online and therefore it always reflects all changes in legislation. With this service you will be able to:

- create invoices and transactions;

- keep registers;

- take into account income and expenses;

- calculate salary;

- calculate taxes and insurance premiums;

- generate reports;

- … etc.

By the way, reporting to the Federal Tax Service will also become easier, because. through the service you can send documents via the Internet. Moreover, the clients of the service always have the opportunity to consult with experts in the field of accounting and taxation.

If your company has entered into a significant document flow, then it may make sense to consider another offer from My Business - a full accounting service. Watch the video presentation of this service:

“My business. BUREAU: a service for checking counterparties

Checking counterparties will help confirm that you are working with reliable companies. Using the service for checking counterparties “My business. Bureau" you will be able to determine the status of the counterparty, as well as check the data on the registration of a company or individual entrepreneur and receive an extract from the Unified State Register of Legal Entities. Moreover, the service will help to find errors if they were made in the details of the company.

Checking and in order to get an extract from the Unified State Register of Legal Entities or check registration data, be sure to specify the TIN and KPP of the counterparty you are interested in.

The service also helps to identify how likely the tax inspectorate or Rospotrebnadzor can come to you.

Functional evaluation

Both individual entrepreneurs and LLCs can work in the Internet accounting "My business". In the first case, it does not matter at all whether the individual entrepreneur has employees or not. If, for example, an individual entrepreneur does not have employees, then he can use the very first tariff called “Without employees”, on which basic functions are available.

The service provides enough opportunities for full-fledged personnel records: for example, in order to create detailed employee profiles, keep track of who was hired and who managed to quit, and also take into account all employees who work remotely.

The tax accounting system is also well organized. With the help of My Business Internet accounting, you can remotely (via the Internet) and also calculate taxes, for example, personal income tax. The service is based on cloud technologies, which means your data will never be lost.

The functionality also includes such sections as warehouse accounting and cash accounting. Functions at a minimum, but they are all necessary. Payroll is another big section of the service. You can calculate all types of deductions for employees (salaries, advances, bonuses, travel allowances, etc.).

Internet accounting "My business" also provides samples of all the basic documents that may be required by entrepreneurs. So, you can use ready-made forms: contracts, invoices, invoices, acts, accounting statements, orders, and so on.

If we compare My Business with other services, then its functionality is approximately on the same level as the most popular programs for accounting and tax accounting. The undoubted advantage of the service is the availability of sample forms - no other service can offer such a variety.

Tariffs "My business"

For LLCs and individual entrepreneurs, 4 tariffs are available to choose from: “Without employees”, “Up to 5 employees”, “Maximum” and “Personal accountant”.

Let's dwell on each in more detail.

| "Without employees" | "Up to 5 employees" | "Maximum" | "Personal accountant" |

| You can keep taxes, generate reports, prepare invoices and primary documents, and keep inventory records. Full access for consultation with experts. The cost is 833 rubles. per month. | You can keep taxes, generate reports, prepare invoices and primary documents, and keep inventory records. Full access to expert advice. Accounting for employees (up to 5 people) is also available. The cost is 1624 rubles. per month. | You can keep taxes, generate reports, prepare invoices and primary documents, and keep inventory records. Full access to expert advice. Work with employees (up to 100 people). The cost is 2083 rubles. per month. | You can keep taxes, generate reports, prepare invoices and primary documents, and keep inventory records. Full access to expert advice. The number of employees to be registered is unlimited. Reconciliation and verification of counterparties is available, as well as special service optimization of tax accounting. The cost is 3,500 rubles. per month. |

As you can see, the rates mostly depend on how many employees your individual entrepreneur or LLC has. The most popular tariff for an LLC is "Maximum", and for an individual entrepreneur - "Without employees", since individual entrepreneurs are most often newcomers, they work alone and prefer to do their own accounting.

Internet bookkeeping My business is online service to control and record various kinds of documentation. This is a reliable and popular resource where real professionals work. The main advantage of the project is that absolutely everyone can work with it, having the opportunity to try out the functionality for free.

Functionality of My Business Service

The main functional features of the site can be summarized in the following list:

- The development team has prepared a unique product, which has no analogues on this moment No

- A special service was developed to work with LLCs and individual entrepreneurs

- Project liability is insured for 100,000 rubles

- Any data is encrypted according to exactly the same scheme as in leading domestic banks

- API for exchanging data with any service that you use

- Integration is set up with the largest banks in the country

- A unique service for checking counterparties has been developed

Online accounting My business has a huge number of differences from competitors, which is why the project has earned popularity so quickly. The above features are far from the only ones.

Tariff plans - My Business

You can try it for free, but the functionality will be somewhat curtailed. To use the program in full, you need to pay for one of the types of access:

- "Internet accounting" will cost you 833 rubles per month of use. At the moment, the tariff is the most economical in the system

- "Personal accountant" includes not only a completely open service, but also a team of assistants and a bot that can perform routine work on its own. Such a complex costs 6600 rubles per month

- "Back office" is the most full program. This option optimized to work with serious businessmen or entire enterprises. Your team will consist of a lawyer, accountant, human resources officer and business assistant, which will allow you to work in a more multitasking mode. The cost of the product is 12.000 rubles per month

Tariffs My business Internet accounting can be studied in more detail on the project website. For all questions, you can contact the current support service.

As you can see, the developers tried to adapt the project to any needs, which will significantly save money, or put everything in order in the process of developing an entrepreneurial business. This service is useful not only for experienced businessmen, but also for beginners who are just starting their journey in hard work.

How to register on the My Business service?

The registration process is extremely simple. The accounting program will become available after you create your personal account. The registration procedure consists of several steps:

- Determine the type of your responsibility (it can be an individual entrepreneur or LLC)

- Specify the system of taxation

- Specify the desired version for working with the service

Also, a document will be offered for review, in which the user will get acquainted with all the provisions of further cooperation. Each field in the registration form is mandatory.

Personal team

When you pay for the full package, a whole team of specialists will begin to cooperate with you, including a personal accountant, business assistant, tax officer, lawyer and personnel officer. Your case will be handed over to professionals who specialize in your industry. Multitasking is the main emphasis on which the work of the service was oriented, so each task will be performed at the highest level.

You can choose a team yourself. To learn more about the list of all actions assigned to the team, you can open a special block on the official website of the resource.

Distinctive features of My Business

Let's take a closer look at the list of the most prominent features of this site:

- . Thanks to this feature, you can quickly get all the data about your counterparty. For example, the site contains the permitted data of the most popular Russian companies such as Aeroflot and Russian Railways

- . This component was given special attention. Each client will be impressed by the automatic operation of the bot named "Andryusha", which copes with the same type of tasks with computer accuracy, and greatly contributes to the acceleration of the workflow

- . You only need to set a well-defined task to a personal assistant. In order to facilitate the process, you send photos of documents, after which all work begins. Even novice businessmen will not be able to make mistakes with paperwork, since the work is carried out by a specially configured bot

- . especially useful given function becomes for retail stores. With the help of cash desks, you can easily control purchases, take inventory, save information about suppliers, work with groups of goods, and so on. The function itself works at 2 different tariffs, information about which can be studied in more detail on the official website

The main advantages and disadvantages of My Business

- Saving you time Incredible time savings, as the tasks will be solved accurately

- Instant support response Usually the wait is less than a minute.

- Convenient and clear functionality Incredible functionality that can solve absolutely every task that the client sets

- original software, unparalleled

- Bot A bot capable of automatically solving many similar tasks

- Simplicity Intuitive use of all functions

- Tariff cost The first thing that users note is the high cost of tariffs, as a result of which competitors in the field of online accounting can offer more favorable conditions.

- Test period A small test period, which is hardly enough to explore all the features of the product

draw conclusions on the topic this service is possible only after independent operation, since it is impossible to describe all the features and advantages within the framework of the article. It is one of the most functional and modern projects of a kind that is gaining more and more popularity in business circles every day.

Personal Area gives you the following options:

- work with primary accounting documents;

- bookkeeping, tax reporting and personnel records management;

- creation of financial statements;

- usage special programs service;

- filling out registration forms legal entity or IP;

- use of the online checkout service;

- verification of counterparties;

- use of the accounting system;

- integration with the bank-client service of a financial institution where the client has a current account.

Online accounting service "My business" offers services in several areas:

- Accountant's office. This service contains forms of accounting documents, checks counterparties, contains the current regulatory framework for accounting, tax, personnel records. Through it you can get advice from a specialist.

- My business. Accountant. The service is designed for accounting, designed in such a way that even a non-specialist can keep records.

- Internet accounting "My finances". The cloud service involves outsourcing the services of an accountant or maintaining documentation on your own.

The personal account contains the following sections: money, documents, stocks, contracts, contractors, forms, analytics, webinars, reports, bureaus.

Registration in the account

To register an account in the personal account of the My Business portal, you need to go to the site at the link http://moedelo-site.ru/vxod-v-lichnyj-kabinet-moe-delo/ , press the button " free registration". Next, select the form of ownership of LLC or IP, the taxation system. We press the "Next" button. A form will open to fill out:

- e-mail;

- telephone;

- password.

Click "Register" and go to the presentation page of the portal. You can watch the video tour or start working on your own in the demo version of the site. In the company profile, the details of the enterprise, public services, to which the reporting is sent, are filled in.

The administrator gets the rights to add and remove companies and other users. If several employees use the service, to add them to the program, you need to open the “Users” folder and click the “Add” button. Enter the last name, first name, patronymic of the employee, email address, contact number, the company and the role of the employee in it. The access rights to the site services depend on the role. The roles are as follows:

- administrator;

- Chief Accountant;

- director;

- payroll accountant;

- accountant;

- senior manager;

- manager;

- storekeeper;

- observer.

Authorization in the personal account "My business"

Login to your personal account is made by login and password. The login button is located on home page site. The login is an email address, and the password is specified during registration. Password recovery is done via email. To do this, click the "Forgot password" button, enter your email address and submit the form. An email will be sent to you with a link that you need to follow to create a new password.

Mobile application of personal account

Accounting "My business" is available from mobile phone. Developed applications for ios and android. Mobile accounting allows you to perform transactions at a convenient time for the client on a trip, at home, on vacation. You can download the application from the AppStore and Google Play. Login to the application is carried out using the same login and password as in the main personal account. Management is carried out through the menu at the bottom of the page.

The "Accounts" section contains full information on made and not made payments, issued invoices, archived data. It is possible to create invoice documents and send invoices by e-mail. The application has access to the Internet service "My business" to carry out operations for the formation of tax reporting, payment of taxes.

Customer support through the office

You can ask a question to a specialist through the Personal Account. Right in upper corner click "Chat", in the window that opens, enter the text, and the bot consultant will answer the question. Also at the bottom of the chat there are icons by which you can go to social networks and ask a question there: Viber, Telegram, Skype, Messenger, Vkontakte. Phone consultations are also provided. hotline 8-800-200-77-15 or by e-mail [email protected]. To view the contact details of technical support, you must click the "Help" button, it looks like a handset and is located next to the "Chat" button.

How to disable my personal account My business

The "Users" section provides for adding and deleting personal accounts of authorized persons and employees of the company. Next to the username, check the box and click the "Delete" button. The system warns that it is not possible to undo the deletion of the user. We confirm the deletion. You can also delete a company. To do this, open the "Companies" tab, select the one you need and confirm the deletion.

Security and Privacy Policy

The data on the My Business server is protected by a security system. All information is copied to additional servers every 15 minutes. In the event of a hardware failure, all current data remains intact. The transfer of information from individual PCs to the server is encrypted at the SSL level. The service is registered in accordance with Federal Law 152 "On the Protection of Personal Data". The company periodically conducts external audits for vulnerabilities.

When using the service, users must follow a number of safety rules:

- install on PC current version antivirus,

- check site address

- do not send your data in response to suspicious emails,

- restrict unauthorized access to the personal account of unauthorized persons.

Filling in sections in the Personal Account "My Business"

The "Money" section contains information about the receipt, debiting and movement Money by account. Filling is done by paying the invoices located in the "Documents" section. Uploading data on the payment of wages occurs in automatic mode on tariffs for individual entrepreneurs and LLCs with employees. Payment of taxes when conducting through the service is also reflected in the list of payments. To do this, go to the "Tax Calendar", calculate the tax and pay it, click the "Done" button. The operation will be carried out on the current date.

In the "Documents" section, you can configure automatic completion deeds and accounts. Contacts and details are uploaded automatically from the program. I have an opportunity manual editing. To upload a seal imprint, the signature of the head and the logo of the organization, you need to make a scan or photo, edit the parameters to suit the system requirements and upload via the "Download" link.

Bank integration

The personal account is integrated with the client bank in which the current account is opened. If there are several accounts, then all banks can be connected. If an entrepreneur uses payment systems, they are connected as follows:

- go to the "Money" tab;

- select "Payment systems";

- select the system we want to connect - Yandex Money, Robokassa, Saipe;

- click "Add".

After integration, clients can manage their account through the My Business personal account. The functions of paying bills, generating payment orders, creating lists of employees and paying them wages are available.

For integration with partner banks, the procedure is the same. You need to select "Settlement accounts", the bank, enter the login and password from the personal account of the bank, the number of the current account, click "Add".

I can't even describe everything here. When everyone submits one or another report, the call center will not get through. To verify this, you can call the call center during the reporting period and see, listen to music, after how much you can get through. Until the beginning of March 2014, the service did not allow for tax reporting. In March 2014, it was already difficult to get through, and 2 weeks before the end of the month it was not realistic to get through, day or night. In my personal account it was written that the provider had problems and write letters. In a letter in April 2014, I asked for information about the provider, since I had previously worked in telecom for more than 15 years, and I am familiar with the regulations and it is not difficult for me to find out the accuracy of this information. It turned out that the notification in the personal account was their cunning. According to the offer, the company gives one answer within 24 hours. However, when they do not have time to respond, they will send something short, as a result, you will have to request a new request and again wait 24 hours. As a result, you can receive a consultation in full for a week. And the company will be clean in front of you. It can be seen that the company is working on this, you can rate the consultation. It's like it was in Sberbank, click on the button, the service suits you. You can write a letter to the company, not in the My business service itself. The company is not responsible for the deadlines for such letters. For example, when I paid for the service My business, how individual prior to registration of the organization. Reflected it on their written consultations. It turned out to be a problem with the unreliability of the checkout. Removed for over a month. According to the accounting consultation, they answered that technical support is involved. According to correspondence with technical support, in fact it turned out to be more than a month. And this despite the fact that I had to get everyone in the company My business (MD). I was happy when everything was decided. And it turned out that this was not the case. When submitting reports for 2014, it was necessary to submit a balance sheet, the service turned out to have a negative result on the cash desk just for the amount paid for the service. Those who read the review will surely understand that since the company was registered in November 2013, everything is zero at the checkout. It was impossible to get through. The problem was also solved for more than a month. Do you think that after this period the service allowed the formation of a balance sheet? That's right, I couldn't. My business service gave an answer after the reporting deadline that since the company was established at the end of 2013, the company may not submit a balance sheet in 2014. And all this time I was on my nerves and had to involve a third-party accountant. In short, the answer was simple, next year they will fix it :-) The service is provided on an "as is" basis. Still want to laugh. Although you have to cry. Recently, I received a promotional code for payment by mail with a 15% discount on the service if I pay before April 30. Ok, I was on the rate without employees. I planned to transfer several employees to employment contracts in May. The offer came in handy. However, the aftertaste from the service My business after the submission of tax returns and the elimination of problems remained unpleasant and, in terms of accounting, I was already thinking about changing the company, I was thinking about leaving the service My business. It was a pity the money paid at the rate for the year. Ok, I thought that the service My business is getting on its feet, so there are enough jambs. Maybe it will get better. I decided to give them another chance, since it is also a young company, and pay them for 2 years in advance at a 15% discount on their offer. I contacted the manager and asked to set off the previously paid amount at a different rate. The answer is interesting, everything that was a gift (and when I connected I received 2 months as a gift for free) the company My business does not consider, that is, it takes the gifts back, and can return the balance of the amount only in the amount of 8% of the remaining months. Phone conversation, they recorded it. I didn't believe my ears. What are they smoking there? Although this is true, they themselves determine the conditions under which they want to work with clients. What do you think, I agreed. Of course not. Since the money was paid earlier, I remain at the same rate. So I think things are probably bad in the company. My business, because everything is so sad and the company is often cunning, that is, deceives. While the contract is in effect, if the situation improves, I will definitely unsubscribe.

Advantages

1. Good idea.

2. Convenience.

3. Availability of electronic reporting with government agencies.

4. Availability of integration with some banks.

5. It is convenient to register a company through the service.

Flaws

1. Long troubleshooting on the service My business is technical support in the development department.

2. Accounting consultations are often incomplete and require clarification.

3. 1 consultation within 24 hours

4. The service is provided "as is" with all problems

5. Inability to get through to technical support during the reporting period, and this is your problem

6. Deceit, as well as hidden lies, in working with clients

7. Employees are not always responsible for their words, only correspondence is an argument, although in correspondence they can also refuse their words, a fact (they really apologize)

8. When refunding amounts for an unused service, you get practically nothing, only 8% (I could be wrong,% is taken from today's telephone conversation with their employee, you need to look at the offer, it should be on their website)

9. There are few banks with which there is integration.