Log into your account with an access code. How to enter your personal account megaphone

Read also

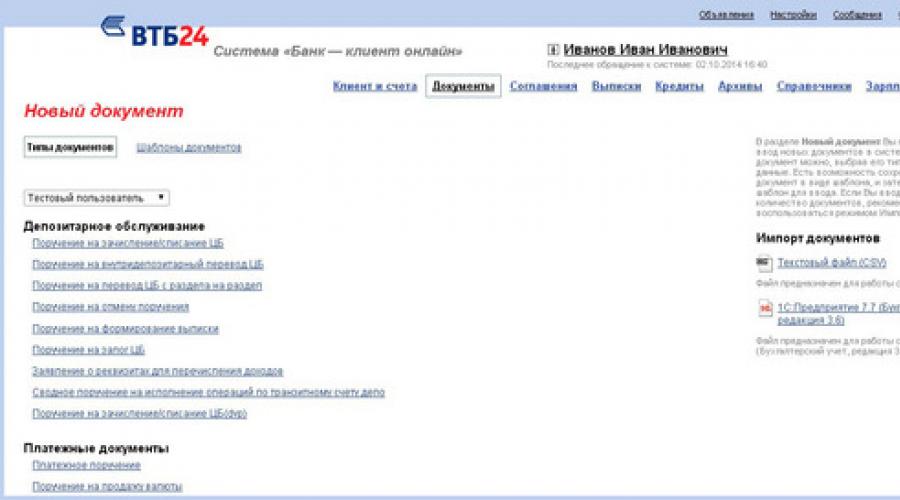

Personal account from VTB24 Internet Bank - perfect solution for advanced users who prefer to manage their finances remotely.

What is VTB24-Online

To be able to use convenient service remote control with their accounts, a bank client needs to register as a user of VTB24-Online or Telebank from VTB24, as it is also called.

VTB24-Online includes:

- Internet banking (online.vtb24.ru)

- mobile version (mob.vtb24.ru and mobile.vtb24.ru)

- mobile app(iOS, Android, Windows Phone)

Types of access to VTB24-Online

After connecting a mobile bank from VTB24, you will be provided with 90 days of free use of the system and free SMS alerts. At the end of the term, you will have to select a paid service type.

Subscription type for using VTB24-Online.

- Informational- to receive traffic information Money On account.

- Standard- includes conducting basic financial transactions on the account of a VTB24 client.

- extended- unlimited, unlimited type of access to your funds.

If you do not want to pay a monthly fee of 500 rubles, choose type 1 or 2 access - they are provided by the bank for free. You will have to pay for advanced functionality.

How to register in VTB24-Online: step-by-step instructions for connecting

What browsers support VTB24-Online?

To access VTB24-Online, you can use the following browser versions:

- Internet Explorer version 9.0 and above (OS Windows families);

- Mozilla Firefox version 31.0 and higher (Windows and Mac OS families);

- Opera version 12.16 and higher (Windows and Mac OS families);

- Google Chrome versions 36.0 and higher (Windows family OS);

- Safari version 7 and up (Webkit 537.71 and up) - (Mac OS).

If you use your mobile phone or tablet, be aware of their increased vulnerability to hacking for fraudulent purposes. We have prepared 7 tips for you safe work with mobile app:

What you need to know about safe work in VTB24-Online

- The system will never ask for your personal data, such as the CVC / CVV code;

- You will not be sent requests for a card number or phone number via SMS;

- When the system fails, bank employees do not call you personally;

- VTB24-Online never asks for a one-time code to cancel an earlier transaction;

- The system never asks for confirmation of the phone number for informing or SMS/Push code.

What is a VTB24-Online token

Token is a password generator for automatic login to the VTB24-Online system. It is presented both in the form of a mobile application and a separate device.

Why is a token needed?

It is designed to automatically generate one-time codes that can be used by the client both to log in to the system and to confirm transactions. What are password generators and how to use them correctly, read our article about password generator.

How to install a token on your phone

To install the VTB24-Online Token, go to the official store of your device: AppStore, Google Play and Windows Store and click Install. Avoid using the browser to install the application: the likelihood of incorrect or fraudulent links increases.

How to activate the "SMS-alerts" service in VTB24 Internet Bank

How to connect and use SMS/Push codes?

What is SMS/Push code?

SMS/Push code is one-time password in the form of an SMS message from VTB24-Online. It comes to your registered mobile number.

Why do you need a one-time password?

It is designed to enter and confirm transactions in the VTB24-Online service.

How to connect "SMS/Push codes"?

In order to be able to confirm transactions using your mobile phone and notifications, you need to contact the nearest branch of VTB24 Bank with your passport and phone number.

Terms of Use

Precautions for Using SMS/Push Codes

- Before using the codes, check the transaction details in the received SMS message;

- Do not enter codes if the content of the SMS notification does not match your actions;

- Carefully check the amount of funds debited;

- If you have not performed any actions in the system, and notifications continue to arrive, call the VTB24 support service.

What is Smart SMS?

Even now, not all subscribers of the Megafon operator are aware that they have the opportunity to manage their account using their personal account. It is worth noting that working with a personal page is unlikely to cause you any difficulties, but first you still need to go through and make a password, which will give you access.

How to get a password from your personal account

There are several ways to do this:

- you can send empty free message to the number 000110. In response, you will receive an SMS containing your login and password;

- if you do not want to bother with SMS, then you can simply dial *105*00#. After a very short period of time, a login and password will be displayed on the screen of your mobile device;

- you can also dial the number of the Megafon operator 0505 - and follow all the instructions of the autoinformer. Be sure to wait for the words "Generate random password", after which in a few minutes you will receive a message with the data you need;

- in addition, you can visit the official website of Megafon, go to the Service Guide portal and, after entering your phone number in the window that opens, click the "Get password" button there.

How to recover a password?

If you do not like your password, then do not worry - you can always change it to something more attractive to you. To do this, you will need to log in using your old login and password, select the "Service Guide Settings" item, and then the "Password Management" sub-item. This is where you can change your password to a new one.

Service Guide Personal Area.

Of course, it may happen that you completely forgot your password, and the message with it was accidentally deleted. However, any password can be recovered, and Megafon's personal account password is no exception.

If this happens, then you can recover your password using any of the methods used during the first registration. These methods are valid for all regions and regions of Russia.

As you can see, everything is quite simple and convenient, the main thing is to follow the above instructions, and then you will succeed, and even losing your password will not be a big problem. If you know another way to get or recover your password or have questions, please leave a comment and don't forget to subscribe to our group.

Settings

To make changes to user settings, click your photo, first name, patronymic and the first letter of the last name in the upper right part of the page or click the corresponding button on the main menu.

On the page Settings you can manage various settings systems Sberbank Online: your profile settings, interface settings, security settings, alert settings, Mobile Banking settings, mobile application settings, etc. To do this, go to the appropriate settings section.

personal information

Chapter personal information designed to edit your personal data. In this section, you can view your passport data, documents and identifiers (SNILS, driver's license, TIN, etc.), add a photo, set the region of service and set up alerts.

Contact Information

The following information is displayed to the right of the photo:

- Your first name, patronymic and the first letter of the last name.

- Mobile phone.

- Work phone.

- Home phone.

Note. Only the first 3 and last 4 digits of each phone number are displayed.

- Payment region.

- E-mail.

Service region selection

To select your region in which the organizations providing services to you are served, click the link All regions. The directory of regions will open, in which all regions will be displayed in alphabetical order. To select the desired region, click its name in the directory. If you want to select all regions, click the link All regions. Then press the button Save. As a result, the name of the selected region will be displayed next to the search bar on the page Transfers and payments, and the search for service providers will be performed in the region.

Email setup

You can customize your email address to receive emails, as well as the email format. To do this, follow these steps:

- Click the button To change the data. A window will open Email setup.

- In field Email enter your email address.

- Select email format:

- Text (letter without pictures).

- HTML email (email with pictures).

- Click the button Save.

- To confirm the operation, press the button Confirm by SMS Confirm. As a result, notification settings will be saved.

- If you do not want to change alert settings, then click Cancel.

Attention! If you have entered into a banking service agreement, then editing contact information You are not available.

Documents and identifiers

In this block, you can specify the insurance number of your individual personal account with the Pension Fund of Russia. This is required if you wish to receive a statement of your personal account. In addition, you can specify the details of an identity document, driver's license, TIN and other documents. To do this, click on the image of the selected document. In order to change the personal account number or specify the details of the document, on the form for viewing the selected document, click the button To change the data. See the relevant sections below for more details.

- Identity document. In this block, you can view your passport data: the name, series and number of the document specified when registering with Sberbank Online (first 4 and last 2 digits). For foreign citizens, this block will display the data of the migration card. Click on the passport image to view.

- insurance certificate. In order to indicate the number of your insurance certificate (SNILS), in this block, click the button Add SNILS. If you want to edit the SNILS number, then in this block click the SNILS image, then click the button To change the data. In the window that opens, in the field SNILS number enter your insurance certificate number. If you want to change the name of the document, then click the icon next to its name and enter a name. Then press the button Save Confirm by SMS. In the corresponding field, enter the one-time password from the message received on your mobile phone, and click the button Confirm. As a result, your insurance certificate number will be stored in the system. If you do not want to change the SNILS parameters, then click the link Cancel.

Delete document. Then press the button to confirm the operation. Confirm by SMS Confirm. As a result, your insurance certificate number will be deleted from the system. If you do not want to delete SNILS, then click the link Cancel.

- Driver's license. To add your driver's license information to Sberbank Online, click the button and click the image of your driver's license. If you want to edit information about a driver's license, then click on the block with the image of a driver's license, then in the window that opens, click the button To change the data. Then do the following:

After filling in all the fields, click the button Save.

Save Confirm by SMS. Next, enter the one-time password from the message received on your mobile phone and click the button Confirm. As a result, the details of your driver's license will be saved in the system.

If you want to delete the document, then click the link Delete document. Then press the button to confirm the operation. Confirm by SMS. In the window that opens, enter the one-time password from the message received on your mobile phone and click the button Confirm. As a result, the details of your driver's license will be deleted from the system.

- TIN. In order to specify an individual taxpayer number, in this block, click the button new document or id and click on the TIN image. If you want to edit the TIN, click the block TIN, a form for viewing details will open, on which click the button To change the data. In the window that opens, in the field TIN number enter your individual tax number and click the button Save.

If you want to change the name of the document, then next to its name, click the icon, enter a name and click the button Save. Then press the button to confirm the operation. Confirm by SMS. In the appropriate field, enter the one-time password from the message received on your mobile phone and click the button Confirm. As a result, your TIN will be saved in the system.

If you want to delete the document, then click the link Delete document. Then press the button to confirm the operation. Confirm by SMS. In the window that opens, enter the one-time password from the message received on your mobile phone and click the button Confirm. As a result, your TIN will be removed from the system.

- Vehicle registration certificate. To add the details of the vehicle passport registration certificate to Sberbank Online, click the button New Document or ID and click on the image of the vehicle registration certificate. A form will open where in the fields "Series" and "Number" specify the series and number of the certificate, and click the button Save.

If you want to change the name of the document, then next to its name, click the icon, enter a name and click the button Save. Then press the button to confirm the operation. Confirm by SMS. In the appropriate field, enter the one-time password from the message received on your mobile phone and click the button Confirm. As a result, your vehicle registration certificate will be stored in the system.

If you want to edit information about the document, then click on the block with the image of the certificate, then on the opened view form, click the button To change the data. A form will open where you can make changes and click the button Save. Then press the button to confirm the operation. Confirm by SMS. Next, in the appropriate field, enter the one-time password from the message received on your mobile phone, and click the button Confirm. As a result, the details of the vehicle registration certificate will be changed.

If you want to remove the certificate, then click the link Delete document. Then press the button to confirm the operation. Confirm by SMS. In the window that opens, enter the one-time password from the message received on your mobile phone and click the button Confirm. As a result, the details of your vehicle registration certificate will be deleted from the system.

Mobile applications

You can download the Sberbank Online mobile application. To do this, in the profile in the side menu, click the link Mobile applications, the connection page will open.

To download a mobile application for the device you are interested in, click on the image or name desired device. In the window that opens, you will see a link to download the mobile application and a barcode containing this link. Or you will go to the bank's website, where you can download the application.

Also on this page you can view your devices connected to the system and disable them. The list for each device shows the type and number of the card with which this device is connected, the type of device (for example, iPhone) and the date it was connected.

If you want to disconnect a device from the system, click the link next to the selected device Disable.

Social networking applications

With the help of the Sberbank Online social application, you can pay for various services in social networks.

To do this, you need to connect the Sberbank Online application to your social networks. To install the application, go to your Profile and in the sidebar click the link Applications social networks .

In order to to plug Sberbank Online application, click the icon of the social network you are interested in, and you will be redirected to the registration page.

If you want to disable Sberbank Online application, click the link Disable app opposite the icon of the social network you are interested in.

Security and Access

In chapter Security and Access You can independently change the security settings of the Sberbank Online system: change your login and password, set login confirmation using one-time passwords, change confirmation settings, etc.

Login change

If you want to change your Sberbank Online login, click the link Login change. Further into the field Enter a new login enter your new login with which you want to log in to the system in the field Repeat new login enter your login again, specifying the same combination of characters. As a result, you will see the security status of the login, by which you can determine its reliability. After the fields are filled in, click the button Save.

You can use the rules to create a login. To do this, click the link How to make a login? As a result, you will be shown a window with the rules for compiling a login.

Attention! When creating a login, the following rules must be observed:

- Enter your login at least 8 characters;

- Use letters of the Latin alphabet and numbers when creating a login, for example, ivan18.

- You can also use the following characters: ""@","_","-",".""

- It is not recommended to enter more than three identical characters in a row.

After the fields are filled in, click the button Save. To confirm the change of login, click the button Confirm by SMS Confirm.

As a result, your login will be successfully changed, and you will be able to use it to log into the system.

Change Password

To change your permanent login password, click the link Change Password. Then in the field Current Password enter your current password, then enter New Password and repeat it with the same character combination. As a result, you will see the security status of the password, by which you can determine its strength. After filling in the fields, click the button Save. Then, to confirm the password change, press the button Confirm by SMS Confirm.

As a result, the new password will be saved, and you will be able to log in to Sberbank Online using it.

Sberbank Online Login Confirmation

In this section, you can change the method for confirming entry to Sberbank Online. To do this, click the link Sberbank Online Login Confirmation.

If you want to be required to enter a one-time password when logging in, check the box. Require one-time password upon login.

As a result, the login confirmation method will change.

Preferred verification method

In this section, you can change the way transactions are confirmed in Sberbank Online. To do this, click the link Preferred verification method.

The way to confirm transactions is a one-time password received on a mobile phone in an SMS or push message.

In order to choose preferred way to confirm login and perform operations, select one of the following radio buttons:

- SMS password.

- Push Notifications.

Save. Then, on the page that opens, to confirm the changes, click the button Confirm by SMS. In the window that opens, enter the one-time password and click the button Confirm.

As a result, the preferred confirmation method in the system will be changed.

Privacy settings

In this section, you can change the visibility setting in mobile applications of information that you are a Sberbank client. Visibility is enabled by default.

If you want to disable the visibility of the "Sberbank Client" feature on your mobile devices in the list of numbers, as well as displaying this sign for you in the contact list of other Sberbank clients, in the block Privacy settings check the appropriate box and click the button Save. Then press the button to confirm the changes. Confirm by SMS. In the window that opens, enter the one-time password and click the button Confirm.

As a result, the setting will be changed.

Product Visibility Setting

You can customize the display of cards, deposits, loans, and other products in Sberbank Online, as well as in ATMs and self-service terminals, and in the Sberbank Online app for mobile devices. To do this, click the link Product Visibility Setting.

Upon entering this page automatically displays a list of products that can be accessed through Sberbank Online.

If you want your card, deposit, loan or other product to be displayed in the list of products in Sberbank Online, check the box display

To specify which products will be displayed in ATMs and terminals, go to the tab ATMs, terminals. Will open grocery list, which you can work with through self-service devices.

Then, if you want your card, deposit, loan or other product to be displayed in the list of products in ATMs and terminals, check the box display next to the selected product.

If you want to set the visibility of products in the Sberbank Online mobile applications, as well as the availability of products for making transactions via SMS requests, go to the tab Mobile devices. A list of products that you can work with in the mobile version of Sberbank Online will open.

In order for your card, deposit, loan or other product to be displayed in the list of products in mobile devices, check the box display next to the selected product.

To specify which products will be available on social networking applications, go to the tab Social Applications. You will see a list of products that you can work with in social applications.

In order for your deposit, card, loan or other product to be displayed in the list of products of the application for social networks, check the box Available for social applications . Then press the button Save, after which the product you have chosen will become available in the social networking application.

If you want to customize the display of closed products, then click the link Show closed.

As a result, after saving and confirming the settings with a one-time password, all your closed cards, deposits, loans or accounts will be displayed in the product visibility settings, and you will be able to set up access to them through Sberbank Online, ATMs, terminals and through mobile applications.

Note. If you have turned off the visibility of any product in full version Sberbank Online, then this product will be displayed when you log in via a mobile device, but you will not be able to receive information on it or perform operations with this product.

After all changes are made, click the button Save. On the page that opens, click the button to confirm the changes. Confirm by SMS. Then, in the window that opens, enter the one-time password and click the button Confirm.

As a result, the settings will be changed.

If you change your mind about doing the operation, then click the link cancel changes and you will be returned to the page Security and access settings.

Setting template visibility

You can independently configure the display of templates in Sberbank Online, as well as in ATMs and self-service terminals, and in the Sberbank Online mobile app. To do this, click the link Setting template visibility.

When you enter this page, a list of templates that can be accessed through Sberbank Online is automatically displayed.

If you want the template to be able to make transactions in Sberbank Online, check the box next to the selected template.

To specify which templates will be displayed in ATMs and terminals, go to the tab ATMs, terminals. A list of templates that you can work with via self-service devices opens.

Then, if you want the template to be displayed in ATMs and terminals, check the box next to the selected template.

If you want to set the visibility of templates for mobile applications, go to the tab Mobile devices. A list of templates that you can work with in the Sberbank Online mobile app will open.

In order for the template to be displayed on mobile devices, check the box next to the selected template.

Note. For templates in the "Draft" status, the visibility setting is not available.

After all changes are made, click the button Save, and the settings will take effect.

Limits on spending on transfers and payments

In chapter Limits on spending on transfers and payments You can:

Setting a daily spending limit

You can set the maximum amount of expenses for transfers and payments during the day, which does not require confirmation in contact center, except for transfers and payments according to templates. To do this, follow these steps:

- If this is your first time setting a daily limit, click the link Not installed. To change a previously set daily limit, click its amount.

- In the window that opens, in the field Daily spending limit enter a daily limit amount that does not exceed the maximum allowable value below. Then press the button Install.

Attention! The operation to reduce the previously set daily limit must be confirmed with a one-time password, and the operation to increase the limit - by calling the Contact Center.

After confirming the operation, a daily limit on the costs of transfers and payments will be set.

You can see the operation of changing the amount of the daily spending limit in the section in the personal menu.

Note. When a zero daily spending limit is set, transfers and payments to Sberbank Online are possible only upon confirmation of the transaction in the Contact Center, while the settings for confirming transfers and payments will not be available.

Note. If the amount of the daily limit of expenses for transfers and payments has been exhausted, you can make the next payment transaction without confirmation in the Contact Center from 00:00 on the day following the day of the operation.

Setting up confirmation of transfers and payments in the Contact Center

You can enable confirmation of all your transfers and payments in the Contact Center (except for transfers between your accounts and cards, as well as transfers and payments based on templates confirmed in the Contact Center). To do this, follow these steps:

- Select a setting and set the corresponding switch to on.

- In the window that appears, to confirm the inclusion of the restriction in the field enter password enter the one-time password from the message received on your mobile phone. Then press the button Confirm.

You can see the operation of enabling this restriction in the section Operation history Sberbank Online in your personal menu.

If you have enabled limits on transfers and payments, then setting the daily limit for spending on transfers and payments will not be available.

When disabling these restrictions, you must confirm the operation by calling the Contact Center.

Alerts

Chapter Alerts is designed to change notification settings for the following events:

- Login to the Sberbank Online system.

- Receiving a letter from the Contact Center.

- Changing the status of execution of operations.

- Sberbank news update.

Note. Notifications about the execution of transactions are sent for transactions in the status "Executed", "Confirm in the contact center" and "Rejected by the bank".

In this section, at the top of the page, according to your settings, the following information can be displayed:

- Phone number to receive SMS messages.

- Your e-mail address for receiving letters, as well as the format of letters. For email settings press the button Change or go to section personal information and press the button To change the data.

To set up alerts, follow these steps:

- For each selected event, set the switch to one of the following possible positions:

- SMS- to send alerts via SMS messages.

- Email- to send notifications to your e-mail.

- Do not deliver- to stop the delivery of notifications.

- Click the button Save.

- Check that the settings have been changed correctly and press the button to confirm the changes. Confirm by SMS.

- In the window that appears Confirm alert settings in field Enter SMS password enter the one-time password from the message received on your mobile phone, and then press the button Confirm.

Attention! Before entering a password, make sure that the transaction details match the text of the message received on your mobile phone. If the data does not match, in no case do not enter the password and do not tell it to anyone, even to Sberbank employees.

Note. For billing alerts, only push notification is available.

Interface

In this section, you can customize the Sberbank Online interface in the way that suits you: change the order of the main menu items and set the visibility of products on the main page of Sberbank Online.

Main menu

In chapter Main menu You can customize the display and order of the main menu items:

- If you want some section not to be displayed in the main menu, drag the selected section to the block Hidden Items menu.

- Also if you want change the order of items in the main menu, then drag the desired section with the mouse up to move left and down to move right.

After everything settings changed, press the button Save, after saving the main menu settings will take effect.

If you want to undo your changes, click the link cancel changes. As a result, you will return to the main page of the system.

Home page customization

In this block, you can independently set up a sequence of cards, deposits, loans and other products on the main page.

If you want to move in list selected card or other product, then hold the cursor, for example, the card and move it higher or lower in the list, then press the button Save. After saving on the main page, the maps will be shown in the new order.

In order to remove from home page desired product, such as a contribution, drag the selected contribution to the section Hidden on the main.

If you would like to receive detailed information to perform operations on any page of the system, then at the bottom of the page click the link Help online.

Elba is protected from password brute force. If you are still worried, set up a two-step login: enter a password, and then receive an SMS or push notification on your phone. We added the second method because SMS is delayed, depends on the work of the operator and the code has to be retyped from the phone. Read the article on how to set it up.

How password login and push notification works

Enter the password on the computer → receive a push notification on the phone → click on it → Elba will open on the computer.

How to set up password login and push notification

If the phone is not listed

Check that notifications are enabled:

1. In the settings of the mobile application,

2. In "Phone settings" → Notifications.

Then go back to settings on your computer and select your phone.

What are push notifications anyway?

Mobile app notifications. Mail Applications they send notifications “3 new letters”, applications for working on the Internet - “file download completed”. Elba apps for

If you are tired of calling the operator for hours to resolve various issues, look for commands and numbers to manage services, and you want to manage your SIM card yourself, now this is possible with a personal account from Megafon.

If this is the first time you want to use the service, we will tell you how to enter your Megafon personal account in order to gain access to all data.

How to get a password from Megafon's Personal Account?

The first login to your personal account is a kind of registration when you receive your password. In order to be able to visit the office, which is also called the service guide, you need to remember this password:

- enter your personal account by entering the address in the search bar https://lk.megafon.ru/login/;

- enter in the field "Phone number" your phone. in the format +7 or starting from 8;

- from the same number send a request in this format * 105 * 00 # ;

- receive by SMS the code that you will need to enter the service guide;

- memorize or save it for yourself.

Now with this password you will be able to visit your personal account to manage your SIM card, tariff plans, services, subscriptions, paid options, purchase packages of minutes, traffic, SMS, order account details, find out the balance of data on packages, bonuses, on your account, contact in a chat with an operator-consultant, study the description of services from the company and much more.

If you lose or forget this password, you can always get a new one by sending a request from your device * 105 * 00 # .

Also have additional ways receive a password: by sending an SMS to 000110 with the text "00", as well as by calling 0505, where voice prompts will lead you to the point « Tariff plans and services" and you will receive a random access code. You can use it to enter the LC.

Authorization instructions

The personal account is available both in the web version via the link and as an application. Authorization will take you only a few seconds. To do this, follow these steps:

- Go from a PC or smartphone, tablet using the link https://lk.megafon.ru/login/. If you are using a mobile application from Megafon "Personal Area", then launch it on your device by selecting it from the menu.

- Enter your phone number, this should be the number from which you first entered your personal account. If you are visiting the page for the first time, indicate the Megafon number.

- Enter in the "Password" line the code that you received during registration, it should have come to you in the form of a notification. If you forgot your password or lost it, restore it by sending the command * 105 * 00 # .

- Click Login to start managing and you will be redirected to the main page.

How to log into your personal account from a modem?

From the modem, the input is carried out in exactly the same way. You get a password for the first time by inserting a SIM card from it into a mobile phone, and then you use it to enter. Now visit the office https://lk.megafon.ru/login/, enter your number, the password you received, click "Login".

How to visit the Megafon corporate personal account?

Login to the corporate personal account is carried out in other ways. This service offers additional features: ordering, receiving documents for reports, changing the tariff, controlling limits and setting them, information about activated options, replacing, restoring SIM cards, linking numbers to company employees.

If you are not yet a corporate client, you must sign a corporate service agreement with Megafon. This is possible even with 1 number. To do this, you need to be a lawyer, notary, legal entity or a private entrepreneur.

If you are already corporate client, you can get the password in two ways:

- at the Megafon office by writing an application, an example of which will be provided to you by a specialist;

- by contacting Megafon support at e-mail [email protected] to send you a sample application for obtaining a password in the personal account.

Login to the corporate office is carried out by the link https://b2blk.megafon.ru/sc_cp_apps/login, for which you need to enter a username and password, as indicated on the page.

What should I do if I can't log in?

Many clients at least once, but faced with the fact that the password does not come after sending the request * 105 * 00 # . In this case, you need to try to dial another command * 105 * 01 #. If the code is not received again, try inserting your SIM card into another phone.

Some phones do not work with these features. Often these include old-style mobile phones. If the problem is not solved, contact the Megafon communication salon in your city or call 0500, waiting for the operator's response. You can also ask a question in the chat on the Megafon website.