1c make the form element required. Validation in Managed Forms

Read also

The need to write off goods from the warehouse in 1C 8.3 arises in two situations: when a shortage is detected, or when the goods become defective - unusable.

In both cases, the write-off of goods in the 1C Accounting 8.3 program is carried out by the document of the same name. The difference lies in the fact that in case of a shortage, the result of the inventory is entered into the program and, based on it, a write-off of goods is created.

In this step by step instructions we will consider exactly the first situation, since otherwise one document of goods write-off is enough for you. All data is entered manually.

Goods inventory

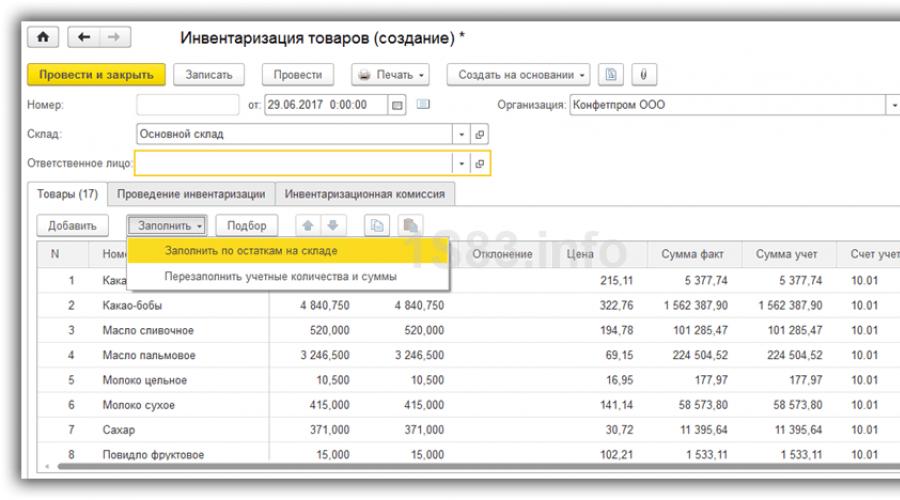

Go to the "Warehouse" menu and select "Inventory of goods".

In the header of the document we created, we indicate the organization and warehouse where the inventory is carried out. For convenience, we will make automatic completion product tables (menu “Fill in” - “Fill in according to stock balances”).

As a result, the table includes all goods that have a balance in the warehouse specified in the document header. The columns "Number of fact" and "Number of accounting" were filled with the same values. To reflect the shortage in our case, we will change the value in the "Amount of fact" column.

For example, as a result of our inventory, it was found that there are only 20 packs of cocoa powder in the warehouse. The balance in the program is 25 units. To reflect this, in the column "Number of fact" we will set the value to "20".

The value "-5,000" appeared in the "Deviation" column. This means that, in fact, a shortage of 5 units of storage of goods was found. Shortage is highlighted in red, excess is highlighted in black.

Now the document can be posted. He does not make any withdrawals. If necessary, the formation printed forms, use the Print menu.

Write-off of goods

A goods write-off document can be created either from the "Warehouse" menu, indicating the inventory in its card, or from the inventory itself. We will use the second method, as it is more convenient.

On the form of the document "Inventory of goods" in the menu "Create based on", select the item "Write-off of goods". In case of detection of an excess of goods in the warehouse, it is created, but in our article we are talking not about that.

The program will open the form of a new document, where everything is already filled in automatically. IN tabular part only those lines for which a shortage is found in the inventory are included. The accounting account was also substituted automatically based on the settings of this stock item (included in the stock item group "Materials").

We won't change anything here. All data was filled in based on what we ourselves indicated in the inventory. Now you can post the document.

Let's look at the generated wiring. Everything is filled in correctly. The goods were debited from account 10.01 "Raw materials" to account 94 "Shortages and losses from damage to valuables."

See also video instruction on registration of write-off:

Any financial and economic transaction on the activities of the company is reflected in the accounts accounting. All accounts are linked. The principle of their interaction is described by the double entry method. Itself is a list in which the number corresponds to the name, reflecting the essence of the business transaction. It was approved by Order No. 94n as amended on 08.11.2010.

A commodity is any purchased or produced item of value intended for subsequent sale. If an organization produces a product for internal use, it is not a commodity. Consider the basic postings for goods and services in accounting.

Consider the main examples of accounting entries for goods on 41 accounting accounts.

Accounting for goods and materials

Goods and materials are often combined into one accounting group and given a general name - inventory items, abbreviated goods and materials.

Ready-made goods and materials intended for further sale are goods. A - these are goods and materials that are purchased for use in the manufacture of the company's products, or for their own needs, affecting the overall production process,.

Inventory and materials are taken into account at the actual cost, which consists of the amounts Money transferred or paid (in cash) to the supplier and other costs associated with transportation, commission costs, etc.

How goods are taken into account

Goods are accepted for accounting in the same way as materials, at actual cost. For accounting, account 41 and subaccounts opened for it are used. When carrying out retail trade, more is needed. If you keep records at discount prices to reflect the difference between them and actual prices, then accounts 15 and 16 will be needed.

Goods are sold wholesale and retail. Accounting in this case is affected by both the taxation system of the organization and the methods enshrined in accounting policy, and automation, or its absence at the point of sale, and the presence of intermediaries. When concluding a supply contract, it is necessary to clearly state all the conditions that relate to prepayment, full payment and shipment, since the write-off of costs and the moment of sale of goods depend on this.

Wholesale trade can be carried out on the terms:

- Prepayment and subsequent shipment.

- Shipment, and then payment for the goods.

- Payment in foreign currency, and then shipment. And vice versa.

- with their transportation to the buyer.

There are also many nuances in retail trade:

- Sale of goods at an automated point of sale (ATT) at sales prices in cash and non-cash.

- Sale of goods at a non-automated point of sale (NTT) at sales prices in cash and non-cash.

- Sale of goods at purchase prices.

Example of postings for 41 accounts

The Alpha organization carries out wholesale and retail trade. Goods were shipped to Omega after receiving full payment from it in the amount of 274,520 rubles. (VAT 41,876 rubles). Three days later, the goods were shipped to the buyer.

The cost of goods sold is 129,347 rubles. In retail, daily revenue amounted to 17,542 rubles. (VAT 2676 rubles). The sale was carried out with the help of ATT. Account 42 was used to account for the trade margin. The amount of the margin is 6549 rubles.

| Account Dt | Account Kt | Wiring Description | Posting amount | A document base |

| 51 | 62.02 | Money received from Omega on the current account | 274 520 | bank statement |

| 76.AB | 68.02 | Advance invoice issued | 41 876 | outgoing invoice |

| 62.01 | 90.01.1 | Accounted for revenue from the sale of goods | 274 520 | Packing list |

| 90.02 | 68.02 | VAT accrued on sales | 41 876 | Packing list |

| 90.02.1 | 41.01 | Written off sold goods | 129 347 | Packing list |

| 62.02 | 62.01 | Advance credited | 274 520 | Packing list |

| Sales invoice issued | 274 520 | Invoice | ||

| 68.02 | 76.AB | Advance VAT deduction | 41 876 | Book of purchases |

| 50.01 | 90.01.1 | Retail revenue included | 17 542 | |

| 90.03 | 68.02 | VAT charged | 2676 | Help-report of the teller cashier based on the retail sales report |

| 90.02.1 | 41.11 | Write-off of goods at the sale price | 17 452 | Help-report of the teller cashier based on the retail sales report |

| 90.02.1 | 42 | Goods markup accounting | -6549 | Help-calculation of writing off the trade margin on goods sold |

Transfer of goods to materials

In production and trade organizations, goods are often transferred to the category of materials. Such a movement is issued by waybill TORG-13.

Alpha purchased 920 meters of cable for sale in the amount of 179,412 rubles. (VAT 27383 rubles). It took 120 meters of cable to carry out electrical work, so this amount of goods was converted into materials.

| Account Dt | Account Kt | Wiring Description | Posting amount | A document base |

| 41.01 | 60.01 | Goods arrived | 152 029 | Packing list |

| 19.03 | 60.01 | VAT included | 27 383 | Packing list |

| 68.02 | 19.03 | VAT accepted for deduction | 27 383 | Invoice |

| 10.01 | 41.01 | Products converted to materials | 19 830 | Invoice for internal movement |

Write-off of goods from 41 accounts for the needs of the organization

An organization may need the goods it sells for general business needs. Write-off can be made by transferring goods into materials or bypassing this operation, on the basis of an order.

Situation example:

The organization purchased 87 reams of paper for retail for a total amount of 7905 rubles. (VAT 1206 rubles.) It took 5 packs for the needs of the office.

| Account Dt | Account Kt | Wiring Description | Posting amount | A document base |

| 41.01 | 60.01 | Goods arrived | 6699 | Packing list |

| 19.03 | 60.01 | VAT included | 1206 | Packing list |

| 68.02 | 19.03 | VAT accepted for deduction | 1206 | Invoice |

| 41.11 | 41.01 | Goods moved from wholesale warehouse to retail | 6699 | |

| 41.11 | 42 | Take into account the trade margin | 2609 | Invoice for internal movement (TORG-13) |

| 26 | 41.11 | Written off goods for the needs of the office | 604 | Invoice claim |

| 26 | 42 | Adjustment of the cost of goods for the needs of the office | 219 | Accounting information |

In this article we will talk about writing off goods in 1C. Write-off can be made based on the results of the inventory or without reference to it.

In order to write off materials in 1C: Accounting 8, you must select the menu item:

Warehouse -> Write-off of goods.

In the 1C: Integrated Automation 8 program, you need to switch the interface to Full.

Then select the menu item:

Documents -> Inventory management -> Goods write-off

In the opened list form, click on the button with a plus sign located on the top panel. In the created document, fill in the details of the organization, warehouse, in a complex configuration put down all 3 checkboxes (accounting, tax and management accounting). If the document is entered on the basis of the inventory formed the day before, then select the inventory document in the corresponding field.

You can fill in the table different ways. If the inventory document is specified, then you can click the Fill -> Fill in according to inventory button and those items from the base document, but which have discrepancies, will be automatically inserted into the table.

If the inventory has not been carried out, then you can manually add rows to the table by clicking on the "plus sign" and selecting them from the nomenclature directory, but I advise you to use more convenient way- "Select" button. After clicking on this button, a panel appears on the side, in the uppermost field of which you must select "By stock items".

Now at the bottom of the panel you can see the list of items and their balance in the warehouse selected in the document. It is more convenient to write off goods in this way than to constantly check the quantity with the balance sheet.

To add a product to the table, you just need to click on it with the mouse and specify the quantity.

You also need to specify the correct ledger accounts for each item item, then you can post the document. Postings are formed in the debit of 94 accounts.